E-Invoicing (FATOORAH) software

ZATCA E-Invoicing Services for Saudi Arabia Easy to connect, Easier to Use

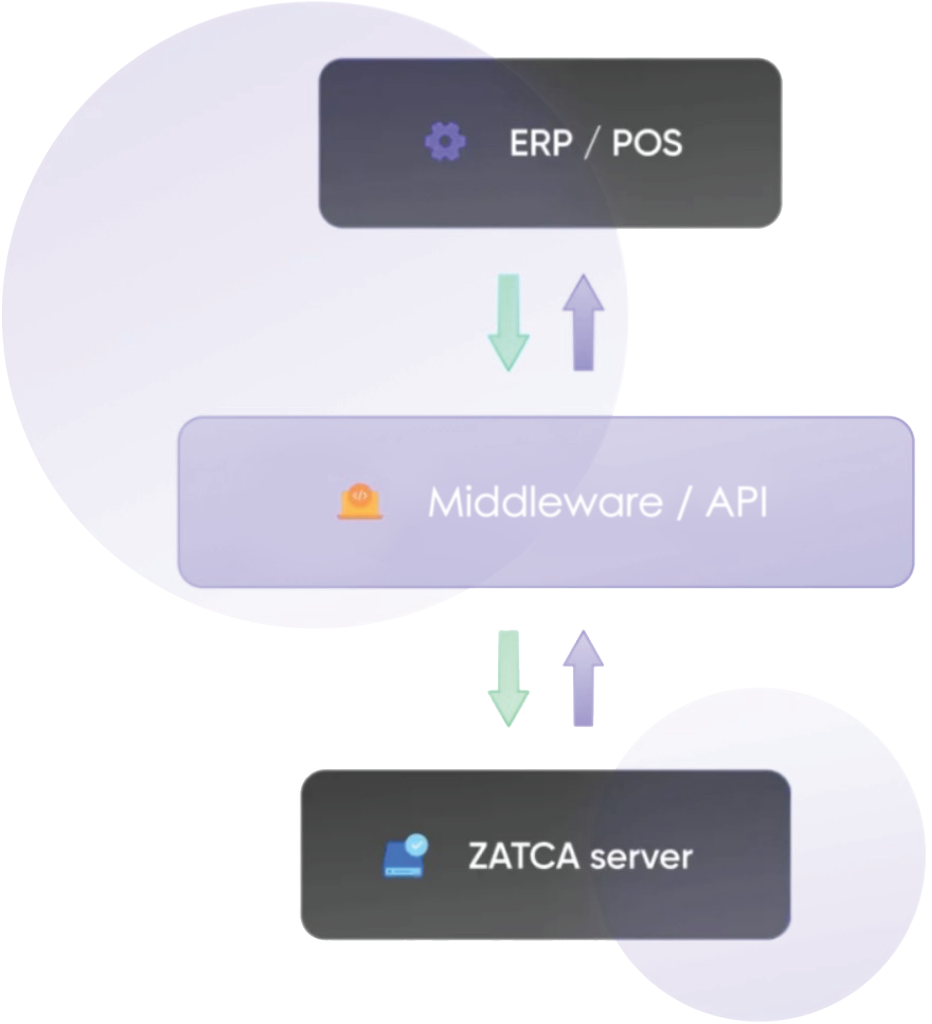

- Integrate with any ERP/ PoS easily

- Invoices in Arabic & English with QR code

- Become phase II ready in one go

About US

Over 5,000+ enterprises onboarded

Clients

Largest e-invoicing software provider globally with 2,500+ customers

Key Features

We are a leading Tax and Compliance SaaS provider

- Fast Bulk generation of '000s invoices in a second

- Integrate seamlessly with any ERP using API, SFTP, and connectors.

- Smart e-Archive Easily searchable archive for data download of 7+ years

- Dependable ZATCA compliant platform with 100% business continuity

- No scale is too steep for us.

- Custom Printing Customized XML embedded PDF templates as needed

- Phase II ready No changes required for Phase II compliance

- Data and Security Data localization and security as per local laws

- Smart insights Dashboards and MIS on web and mobile platform

Smart reporting and MIS

Store and bulk download historical data

Never lose track of data. Download bulk data till 7 years instantaneously

Search invoices in just milliseconds

Easily search your e-Archive via invoice number, date, buyer details etc.

Intelligent dashboards at your fingertips

Get management level real time dashboards on our cloud platform or mobile app

Your data security is our priority

We take no chances when it comes to the security of our clients’ data. We are at the cutting edge of enterprise-grade cyber security.

Data Residency

We ensure that all your data gets stored within KSA as per government mandate

Benefits of Cloud based e-invoicing Software

Minimal changes in ERP or POS

Smart reporting & MIS dashboard

Seamless implementation in few days promise icon

Easy reconciliation of VAT & e-invoicing

Accuracy / compliance

Bulk e-invoice generation

24/7 customer support

Round the clock on-call engineers and 100+ CA’s to resolve any issue whenever you need it.

Request for proposal

Meeting suggestion

We will try and understand your system architecture & discuss details of what it will take for you to get 100% compliant.

E-Invoicing Services in KSA

The Kingdom of Saudi Arabia is undergoing a major digital transformation, and one of the key initiatives in this journey is the introduction of e-invoicing. The Zakat, Tax and Customs Authority (ZATCA) has implemented a structured approach to ensure that businesses comply with the latest e-invoicing regulations. At Insights KSA, we specialize in providing comprehensive e-invoicing services in Saudi Arabia to help businesses seamlessly transition to the digital era while staying compliant with local regulations.

Understanding ZATCA E-Invoicing

ZATCA has introduced a mandatory e-invoicing system to ensure transparency and efficiency in financial transactions. This system is designed to streamline tax collection and reduce tax evasion, making compliance a necessity for businesses operating in Saudi Arabia. Our expertise in ZATCA e-invoicing ensures that your business is fully aligned with the latest regulatory requirements, avoiding penalties and ensuring seamless operations.

The Importance of E-Invoicing Phase 2

The implementation of e-invoicing phase 2 is a crucial step in the evolution of Saudi Arabia’s financial ecosystem. While Phase 1 focused on generating and storing e-invoices, Phase 2 introduces integration with ZATCA systems for real-time reporting. Businesses must adopt robust e-invoicing software to meet these new requirements. Our team at Insights KSA assists organizations in selecting, implementing, and maintaining the right e-invoicing software solutions that align with ZATCA’s regulations.

Why Choose Our E-Invoicing Services in Saudi Arabia?

Navigating the complexities of ZATCA e-invoicing regulations can be challenging for businesses. That’s where we come in. Our e-invoicing services in Saudi Arabia provide end-to-end support, ensuring that businesses of all sizes can comply with regulatory standards effortlessly. Whether you are a small business or a large corporation, our experts help you implement a seamless e-invoicing software system tailored to your specific needs.

Benefits of Implementing E-Invoicing Software Solutions

1. Regulatory Compliance: Our e-invoicing software solutions are designed to meet ZATCA’s compliance requirements, ensuring that your business avoids penalties and legal issues.

2. Increased Efficiency: Automating invoicing processes reduces manual work, saving time and minimizing errors.

3. Enhanced Security: Digital invoices ensure data integrity and prevent fraudulent activities.

4. Seamless Integration: Our solutions integrate with your existing ERP and accounting systems, ensuring smooth operations.

5. Real-Time Reporting: With e-invoicing phase 2, businesses must submit invoices to ZATCA in real-time, making compliance easier with automated solutions.

Choosing the Right E-Invoicing Software

Selecting the right e-invoicing software is essential for a smooth transition to digital invoicing. We provide tailored e-invoicing software solutions that meet the unique requirements of businesses across different industries. Our solutions are designed to support both e-invoicing phase 2 and the broader goals of e-invoicing ZATCA compliance.

Einvoice Implementation Process

Our einvoice implementation process is designed to ensure a hassle-free transition. We follow a structured approach that includes:

1. Assessment & Consultation: Understanding your business needs and compliance requirements.

2. Software Selection: Recommending the most suitable e-invoicing software solutions for your operations.

3. Integration & Testing: Seamless integration with existing systems, followed by rigorous testing.

4. Training & Support: Providing training to your team and ongoing support to ensure compliance.

Get Started with E-Invoicing Services in KSA

At Insights KSA, we are committed to helping businesses adapt to digital transformation with ease. Our e-invoicing services in KSA are designed to simplify compliance, enhance efficiency, and future-proof your invoicing processes. Contact us today to learn more about how our ZATCA e-invoicing solutions can benefit your business and keep you ahead in the digital economy.