In the whirlwind of HR, accounting, and compliance demands, payroll processing issues are often the silent disruptors to smooth business operations in Saudi Arabia (KSA). If you think this is an exaggeration, wait until you’re juggling complex regulatory requirements, struggling with late payments, or staring at an employee retention problem because of salary delays. Let’s break down the key issues businesses face and, more importantly, how to fix them. Get ready to dive into the payroll services world with a sprinkle of solutions and the latest Insights KSA for 2025!

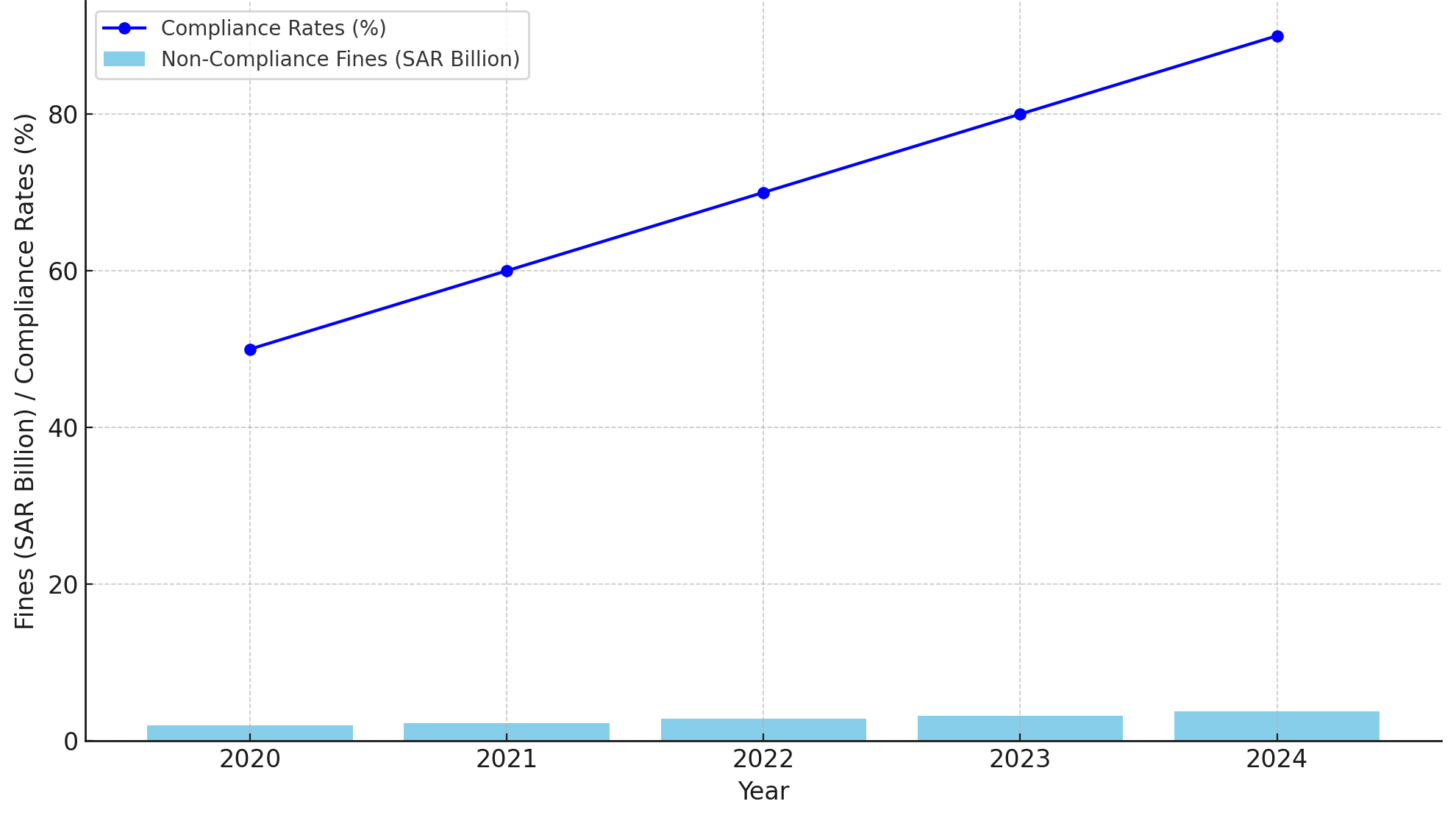

Compliance with Ever-Changing Regulations

Navigating the labyrinth of Saudi Arabia’s dynamic labor laws is a challenge that keeps even the most experienced HR professionals on their toes. Regulations such as Saudization quotas, WPS (Wage Protection System) mandates, and the annual updates to the Labor Law can be overwhelming. The cost of non-compliance is steep—fines exceeded SAR 3 billion in 2024 alone, and compliance-related lawsuits rose by 18% compared to 2023, according to the Saudi Ministry of Human Resources.

Adding to the complexity, KSA’s labor regulations frequently incorporate new technology-driven tracking mechanisms, making manual compliance nearly impossible. For example, the updated WPS guidelines now require real-time salary disbursement reporting, which has caught many businesses off-guard.

Why Is This Such a Headache?

- Frequent Updates: Labor laws are modified multiple times a year, and missing an update can lead to penalties.

- Multi-Tier Compliance: Companies must ensure compliance not just at the employee level but also at organizational and contractual levels.

- Technology-Driven Monitoring: With digital systems like the updated WPS, authorities have real-time visibility into payroll practices, increasing the risk of penalties for delays or inaccuracies.

Solution:

Investing in advanced payroll solutions with built-in compliance features is no longer optional—it’s a survival strategy. Automated systems like those offered by Insights KSA can:

- Monitor Regulatory Changes: Real-time updates ensure that your payroll practices align with the latest laws.

- Generate Compliant Reports: Seamlessly produce WPS-compliant files and other mandatory reports.

- Conduct Automated Audits: Identify compliance risks before authorities do, saving you from penalties.

Regular training sessions for HR and payroll teams are equally important. Insights KSA also provides tailored training modules to help your team stay up-to-date.

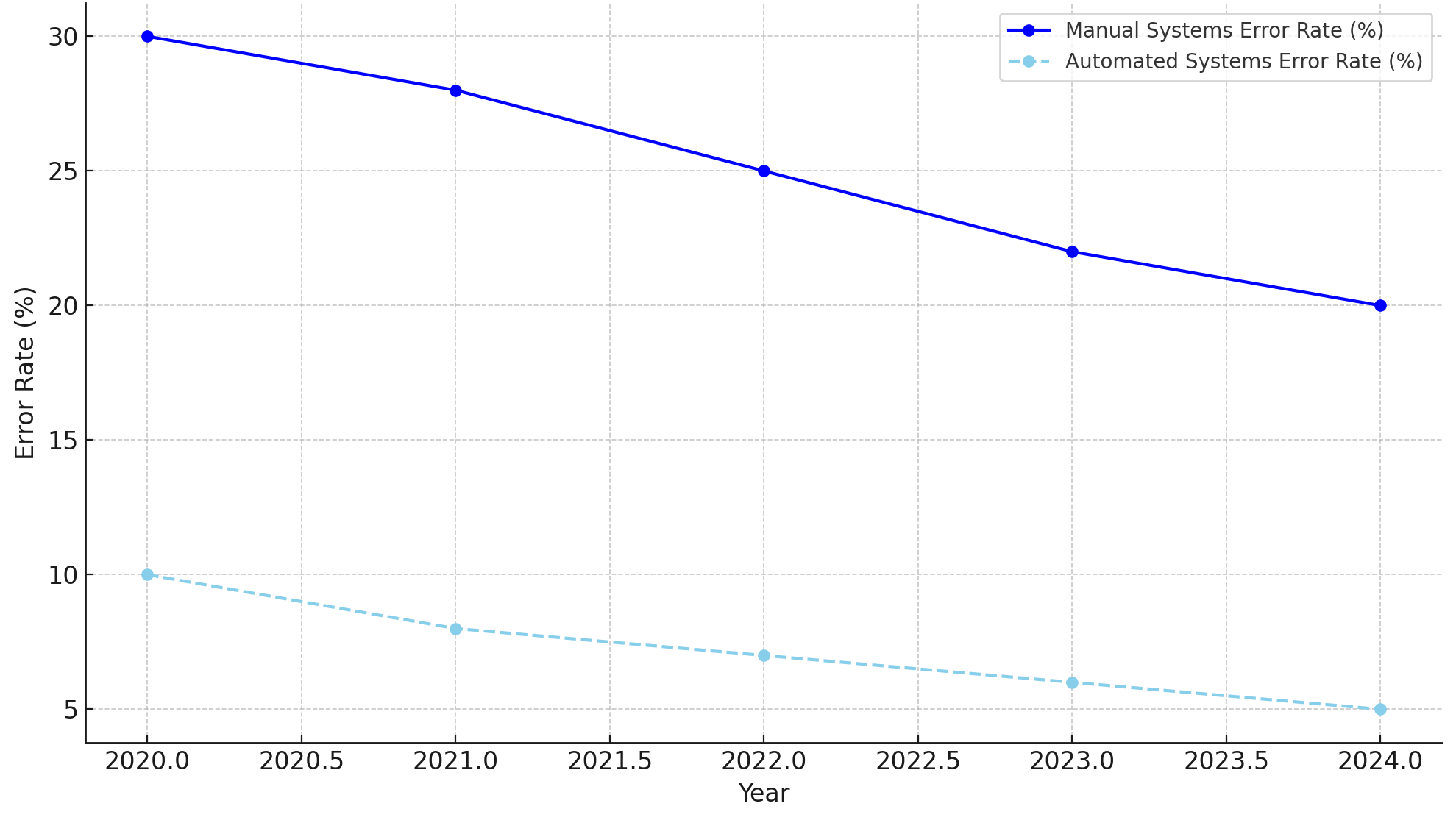

Manual Payroll Processes – The Recipe for Chaos

Imagine this: your HR team spends hours or even days manually calculating salaries, deductions, and overtime, only to end up with mistakes that trigger employee dissatisfaction. Manual payroll processes in KSA are not just outdated but a potential financial black hole. Studies from late 2024 reveal that 70% of payroll errors occur due to human oversight in manual processes. These errors can lead to financial losses exceeding SAR 120,000 annually for medium-sized businesses.

What Makes Manual Payroll So Problematic?

- Error-Prone Calculations: Salaries, overtime, and deductions require precision. Manual processes often lead to calculation mistakes that impact employees’ trust.

- Time-Intensive: Manually processing payroll takes an average of 30 hours per month for small and medium-sized enterprises, time that could be better spent on strategic HR activities.

- Lack of Scalability: As your business grows, manual systems crumble under the pressure of increased complexity and volume.

- Compliance Risks: Human error in manually updating compliance changes often results in penalties, especially in regions like KSA where regulations are stringent.

Solution:

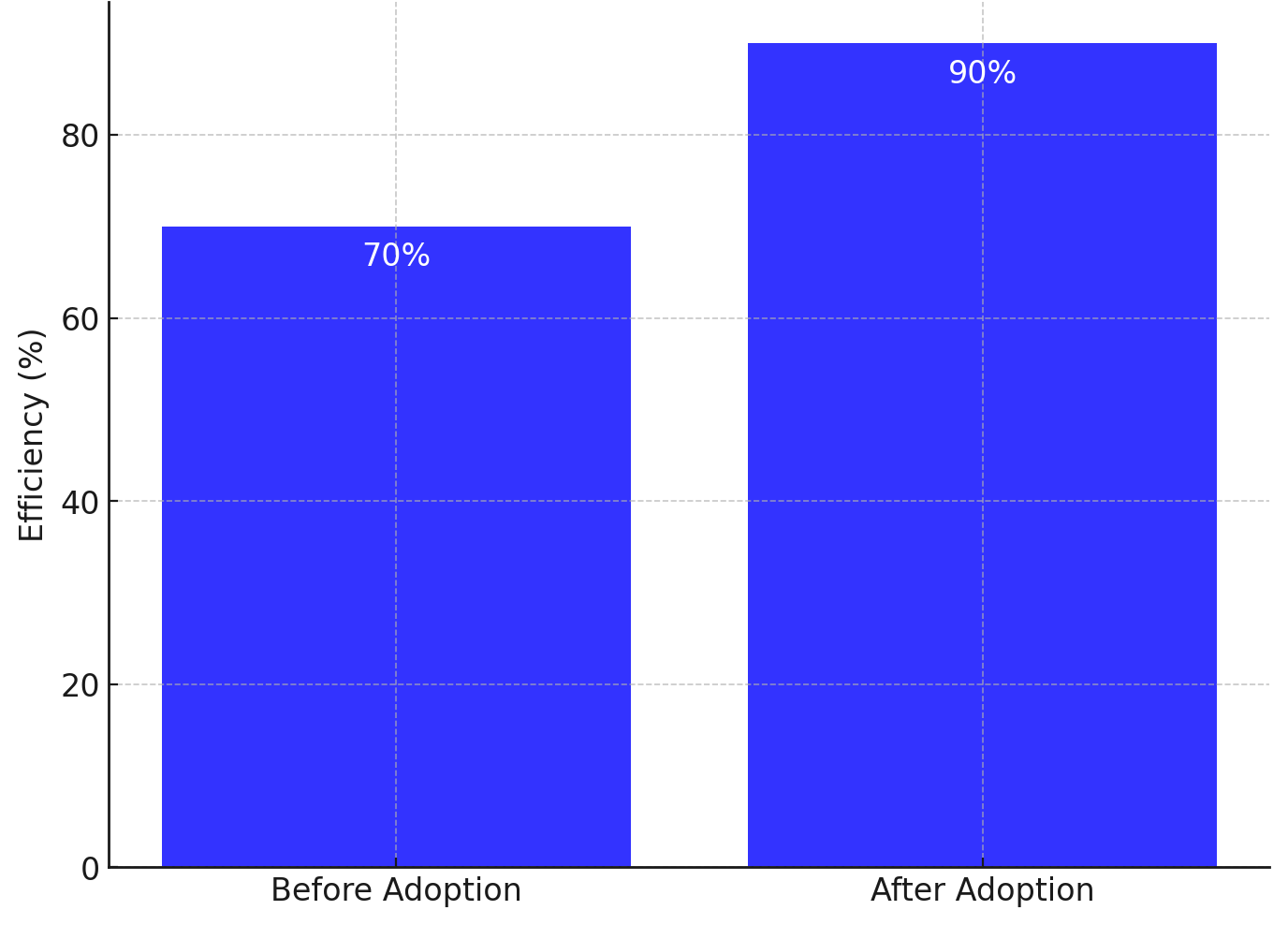

The solution is simple yet powerful: automation. Here’s how automating your payroll can tackle manual woes:

- Real-Time Accuracy: Advanced payroll software eliminates calculation errors by automating salary, overtime, and deduction computations. Insights KSA payroll systems are designed to adapt to KSA-specific rules, ensuring error-free processing.

- Time-Saving Tools: Automation reduces processing time by over 50%, allowing HR teams to focus on core tasks rather than repetitive calculations.

- Built-in Scalability: Automated solutions can handle payroll complexities as your workforce grows, seamlessly accommodating new employees, variable pay, and benefits.

- Compliance Automation: Insights KSA tools incorporate real-time regulatory updates, ensuring compliance without manual intervention.

The Impact of Automation:

According to a 2024 GCC payroll survey, businesses that automated their payroll processes experienced a 60% reduction in processing errors and improved employee satisfaction by 25%. Automation isn’t just a convenience; it’s a strategic advantage.

Lack of Integration Between Payroll and Other Systems

The digital age demands seamless workflows, but for many businesses in KSA, payroll operates as an isolated system. Disconnected HR, accounting, and payroll systems often lead to inefficiencies and errors. Research from a GCC technology survey in 2024 showed that 40% of payroll errors stem from data mismatches due to poor system integration. These errors, on average, cost companies an extra SAR 150,000 annually in reconciliation efforts.

Why Does This Happen?

- Data Silos: HR handles attendance, accounting tracks finances, and payroll processes salaries—when these systems don’t communicate, inconsistencies arise.

- Manual Interventions: Without integration, data transfer between departments is prone to human errors.

- Limited Reporting: Isolated systems make generating comprehensive payroll reports a tedious task, delaying insights needed for decision-making.

Solution:

Integration is the name of the game. Here’s how businesses can tackle this challenge:

- Adopt Unified Platforms: Invest in solutions like Insights KSA payroll system, which integrates seamlessly with HR and accounting software. This eliminates silos and ensures real-time data synchronization.

- Centralized Dashboards: Unified systems provide centralized dashboards for tracking employee attendance, payroll, and benefits, offering a holistic view of workforce management.

- Automated Data Transfers: Bid farewell to manual uploads and downloads. Integrated systems automate data flow, reducing the risk of errors.

The Competitive Edge:

Companies leveraging integrated payroll solutions reported a 30% reduction in administrative workload and a 20% increase in data accuracy in 2024. Insights KSA ensures smooth operations by bridging the gaps between departments, empowering businesses to stay agile.

Currency and Exchange Rate Challenges

With KSA’s diverse workforce, salaries often need to be paid in different currencies. Fluctuating exchange rates can lead to incorrect payments, employee dissatisfaction, and accounting errors. A 2024 report by a regional banking authority noted that 25% of payroll errors in multinational companies were linked to mismanaged currency conversions.

Solution:

Use payroll systems with built-in multi-currency support and exchange rate updates. Advanced solutions can even lock in favorable rates for payroll periods, saving your business money. A recent survey found that 87% of multinational companies in the UAE and KSA experienced smoother payroll operations after adopting multi-currency payroll software.

Data Security Risks

In a world where sensitive employee data is gold, payroll systems are prime targets for cyberattacks. As of 2024, 15% of businesses across the GCC reported breaches in their payroll systems, with the average cost of recovery exceeding SAR 200,000 per incident. Beyond financial implications, breaches compromise employee trust and can lead to severe legal consequences under KSA’s strict data protection laws.

Why Are Payroll Systems Vulnerable?

- High-Value Data: Payroll systems contain sensitive information like bank account details, salary figures, and personal identification, making them attractive to cybercriminals.

- Lack of Updates: Outdated systems are often poorly equipped to handle modern cyber threats.

- Insider Threats: Without proper access controls, even trusted employees can unintentionally (or maliciously) expose data.

Solution:

To mitigate these risks, businesses need robust security measures:

- Advanced Encryption: Ensure payroll data is encrypted both in transit and at rest, making it nearly impossible for unauthorized parties to access it.

- Role-Based Access: Limit data access to essential personnel only. Insights KSA solutions allow businesses to customize access levels, ensuring sensitive information remains protected.

- Regular Updates and Audits: Keep systems updated with the latest security patches and conduct regular audits to identify vulnerabilities.

- Employee Awareness: Train employees on cybersecurity best practices, reducing the risk of phishing and other attacks.

2025 Payroll Trends and Stats to Watch

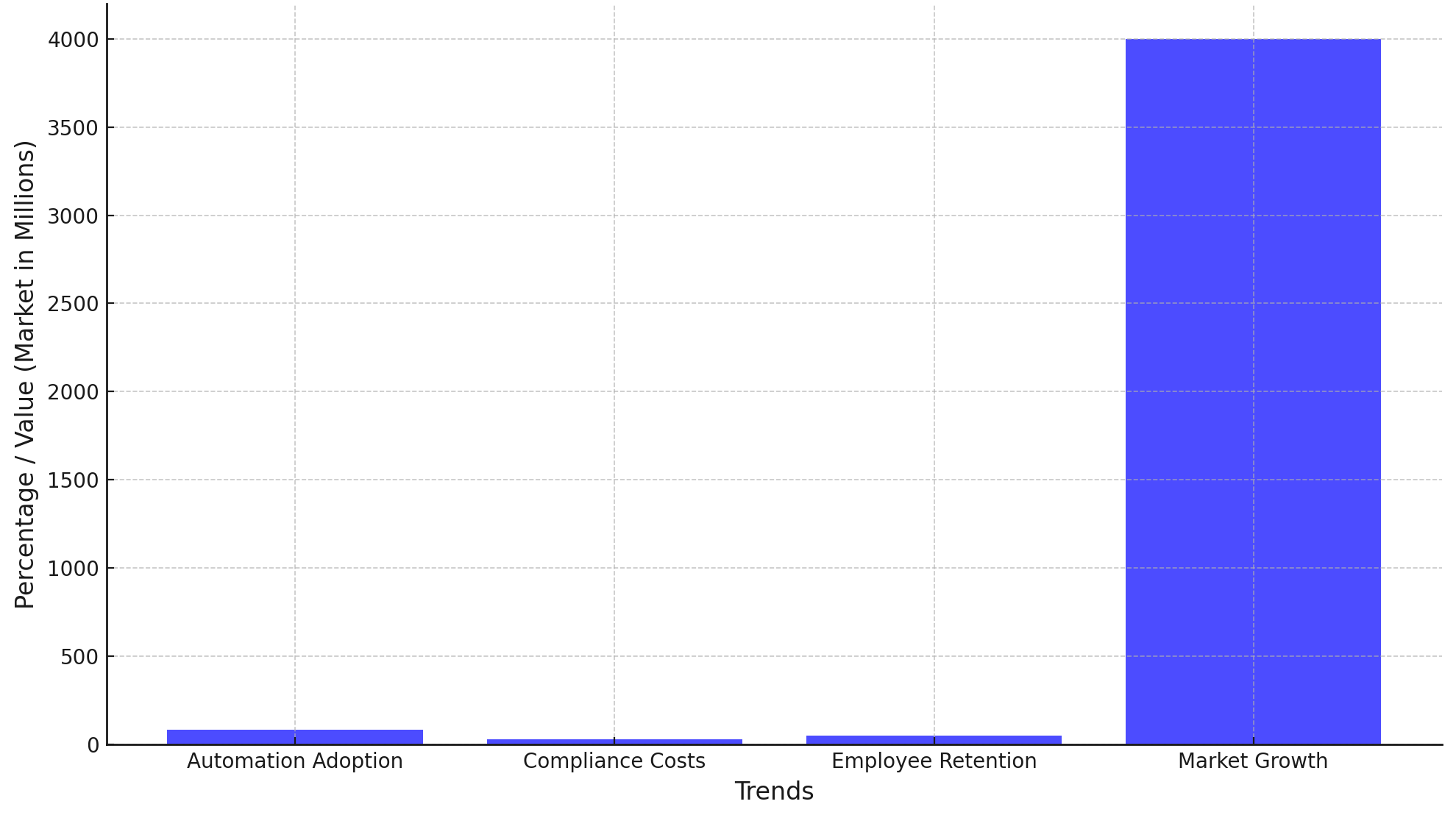

Let’s dive into the numbers to understand the payroll landscape better:

- Automation Adoption: By early 2025, 85% of businesses in the GCC plan to automate payroll processes, citing increased accuracy and efficiency.

- Compliance Costs: Non-compliance fines in KSA rose by 30% in 2024, making it critical to stay updated.

- Employee Retention: Companies with streamlined payroll processes report a 50% lower turnover rate than those with frequent salary delays.

- Market Growth: The payroll software market in the MENA region is expected to hit $4 billion by 2025, driven by digital transformation initiatives.

How Insights KSA Can Help You

Insights KSA doesn’t just provide payroll solutions; we revolutionize how businesses approach payroll processing issues. Here’s how we can transform your payroll experience:

- Compliance Mastery: Stay ahead of Saudi labor law updates with real-time alerts and automated compliance checks.

- Seamless Integration: Connect HR, accounting, and payroll in a single platform to save time and reduce errors.

- Data Security: Fortify your payroll systems with cutting-edge cybersecurity to protect sensitive employee information.

- Tailored Features: Whether it’s multi-currency support or customized reporting, we’ve got you covered.

Payroll processing issues can feel like an endless rollercoaster, but with the right tools and strategies, you can turn chaos into control. From automating processes to safeguarding compliance, the solutions are at your fingertips. And remember, you don’t have to do it alone. Insights are here to help businesses across KSA conquer their payroll challenges and embrace a future-ready approach.

Ready to level up your payroll game? Contact us at Insights KSA today and say goodbye to payroll headaches in 2025 and beyond!