Actuarial valuation is a cornerstone of financial stability and planning within the life insurance industry. It is the process of assessing the financial position of an insurance company by determining its liabilities and ensuring sufficient reserves to meet future claims. For policyholders, it offers the assurance of stability and reliability, and for insurance companies, it’s a critical tool for maintaining solvency and compliance.

The three essential aspects of actuarial valuation in life insurance, explaining its importance and how professional actuarial valuation services provide critical support to insurers. Along the way, we’ll also examine how organizations like Insights KSA and actuarial valuation consultants can make a difference in this specialized field.

What Is Actuarial Valuation in Life Insurance?

Actuarial valuation in life insurance refers to the process of analyzing and calculating the liabilities associated with insurance policies. It involves sophisticated statistical and mathematical techniques to assess the value of future policy benefits. Insurance companies use this valuation to ensure they have enough reserves to cover future claims and liabilities.

In essence, actuarial valuation ensures that an insurer can fulfill its obligations to policyholders. This not only safeguards the financial health of the company but also fosters trust among policyholders.

To better understand actuarial valuation in life insurance, let’s explore its three essentials:

Essential #1: Liability Assessment

At the heart of actuarial valuation lies the assessment of liabilities. Insurance companies are required to hold sufficient reserves to pay future benefits to policyholders. These reserves are determined based on various factors, including:

- Policy Terms: The type and duration of policies issued.

- Demographics: Age, health status, and other characteristics of policyholders.

- Economic Assumptions: Interest rates, inflation, and investment returns.

- Mortality Rates: Statistical probabilities of death among the insured population.

Actuarial valuation consultants utilize advanced statistical tools to predict the future obligations of an insurer. This prediction helps ensure that the company is financially prepared to handle claims as they arise. Consulting companies in Saudi Arabia, such as Insights KSA, have developed expertise in applying these methodologies within the local market context.

Essential #2: Regulatory Compliance

Insurance companies must adhere to strict regulations to operate within the financial ecosystem. Actuarial valuation in life insurance is integral to meeting these regulatory requirements. Regulatory bodies require periodic valuation reports to:

- Verify the solvency of the company.

- Assess the sufficiency of reserves.

- Ensure compliance with risk-based capital requirements.

- Maintain transparency and accountability.

Actuarial valuation services provided by professional firms or actuarial valuation companies often include a thorough examination of compliance metrics. These services help insurers align with both local and international regulatory frameworks.

In Saudi Arabia, where the financial sector is growing rapidly, regulatory compliance has become a significant focus. Insights KSA, with its extensive understanding of local regulatory environments, can help insurance companies navigate these requirements effectively.

Essential #3: Strategic Decision-Making

Actuarial valuation is more than a compliance exercise—it’s a strategic tool. The insights derived from actuarial calculations enable insurance companies to make informed decisions about their operations, such as:

- Pricing Policies: Setting premiums that balance affordability for customers and profitability for the company.

- Product Design: Designing insurance products tailored to market needs.

- Investment Strategies: Allocating assets to ensure long-term financial stability.

- Risk Management: Identifying and mitigating potential financial risks.

Consulting companies in Saudi Arabia have increasingly focused on integrating actuarial insights into strategic planning. For example, actuarial valuation consultants from Insights KSA provide data-driven recommendations that empower insurers to make strategic decisions with confidence.

Recent Trends in Saudi Life Insurance Market

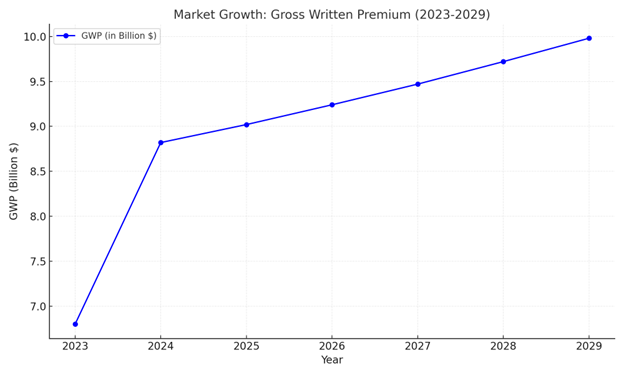

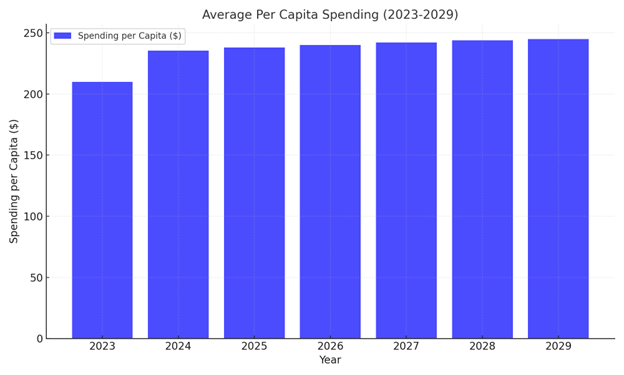

- Market Size: The gross written premium (GWP) for Saudi Arabia’s life insurance market is projected to reach approximately $8.82 billion in 2024, with an average spending per capita of $235.40.

- Growth Rate: The market is expected to grow at a CAGR of 2.50% from 2024 to 2029, reaching $9.98 billion by 2029.

- Premiums: Direct written premium was SAR 2.6 billion ($684.2 million) in 2023, with a forecasted CAGR of over 8% during 2024–2028.

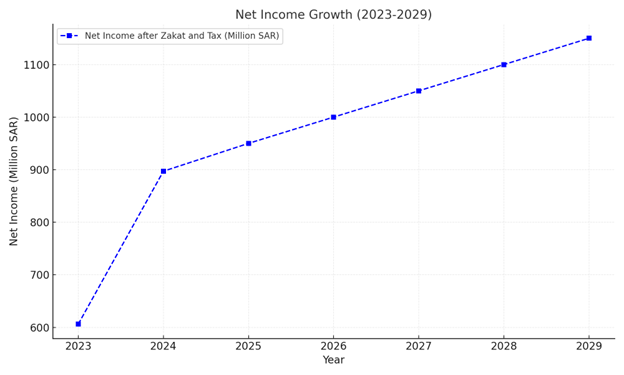

- Profitability: The sector reported a net income after zakat and tax of SAR 897 million in Q1 2024, up from SAR 606 million in Q1 2023.

Market Growth

This chart illustrates the projected growth of Gross Written Premium (GWP) from 2023 to 2029, highlighting the upward trajectory of the life insurance market in Saudi Arabia.

Per Capita Spending

The bar chart showcases the increase in average per capita spending from 2024 to 2029, reflecting the growing interest and investment in life insurance products.

Net Income Growth

This chart demonstrates the rise in net income after zakat and tax, comparing figures from Q1 2023 to Q1 2024, emphasizing the financial stability and profitability of the sector.

The Role of Professional Services in Actuarial Valuation

Given the complexity of actuarial valuation, it’s no surprise that insurance companies often rely on specialized actuarial valuation services. These services provide:

- Expertise: Access to professionals with extensive knowledge of actuarial science.

- Efficiency: Streamlined processes that save time and resources.

- Accuracy: Precise calculations and assessments that mitigate risks of miscalculation.

Actuarial valuation companies employ cutting-edge technology and methodologies to deliver insights that shape the future of life insurance. Whether it’s forecasting future trends or ensuring regulatory compliance, these companies play a vital role in the industry.

How Insights KSA Can Help You

Insights KSA has established itself as a leader in providing actuarial valuation services in Saudi Arabia, offering exceptional support to life insurance companies by combining global expertise with a deep understanding of the local market.

- Insights KSA excels in delivering customized solutions. They adapt their actuarial services to the unique requirements of each insurer, ensuring the services provided are both relevant and highly effective. This bespoke approach helps insurers address specific challenges and seize opportunities tailored to their business models.

- The company’s regulatory expertise is a vital resource for navigating the complexities of both local and international insurance regulations. Insights KSA ensures that insurers remain compliant with all necessary standards, minimizing risks and safeguarding their operations.

- Insights KSA offers comprehensive analysis, spanning everything from liability assessments to advanced risk management strategies. Their all-encompassing approach ensures that insurers can rely on accurate and insightful evaluations of their financial positions and obligations.

- The firm provides strategic insights that extend well beyond regulatory compliance. These actionable insights empower insurers to make informed decisions, optimize operations, and design effective long-term strategies that enhance both profitability and customer satisfaction.

Whether you are a startup seeking to establish a strong presence in the life insurance sector or an established company looking to refine your strategies, Insights KSA is well-equipped to assist you at every step of the actuarial valuation process. With their professional guidance, insurers can confidently navigate the complexities of the industry and position themselves for sustained success.

Actuarial valuation in life insurance is a critical function that underpins the financial health of insurance companies. By focusing on liability assessment, regulatory compliance, and strategic decision-making, insurers can ensure they are well-prepared to meet their obligations and capitalize on growth opportunities. As the financial landscape continues to evolve, leveraging the expertise of Insights KSA can provide insurance companies in Saudi Arabia with the competitive edge they need to succeed. By embracing professional actuarial valuation services, insurers can build trust with policyholders, meet regulatory standards, and position themselves for long-term growth.

Sources links:

- https://www.statista.com/outlook/fmo/insurances/life-insurance/saudi-arabia?utm_source=chatgpt.com

- https://www.ia.gov.sa/Documents/sector-report/Quarterly_Insurance_Sector_Report_Q1_2024.pdf?utm_source=chatgpt.com

- https://www.globaldata.com/store/report/saudi-arabia-life-insurance-market-analysis/?utm_source=chatgpt.com

- https://www.fitchratings.com/research/insurance/saudi-arabian-insurance-dashboard-february-2024-14-02-2024?utm_source=chatgpt.com