As Saudi Arabia embarks on Vision 2030—a transformative economic blueprint—businesses across the Kingdom must adapt to a rapidly evolving landscape. While the nation experiences robust growth, driven by initiatives like NEOM and expanding sectors such as tourism, poor market risk management can pose significant threats to businesses operating within this dynamic environment.

In this article, we will delve into three critical warning signs that businesses in Saudi Arabia may face in 2025 and explore strategies for mitigating these risks. Supported by recent 2024-2025 data, we will also provide actionable insights that align with the context of the Saudi economy. Let’s begin by understanding what makes market risk management a vital component of your business strategy.

What is Market Risk Management?

Market risk management involves identifying, analyzing, and mitigating potential financial and operational risks that stem from external market factors. These risks include interest rate fluctuations, currency volatility, geopolitical events, and changes in consumer behavior. Companies that lack robust market risk management strategies expose themselves to unforeseen challenges, potentially jeopardizing profitability and stability.

Insights KSA, a leading consultancy firm in the Kingdom, emphasizes that with Saudi Arabia’s increasing integration into global markets, businesses must prioritize resilience and adaptability to navigate uncertainties effectively.

The Economic Context of Saudi Arabia in 2024 – 2025

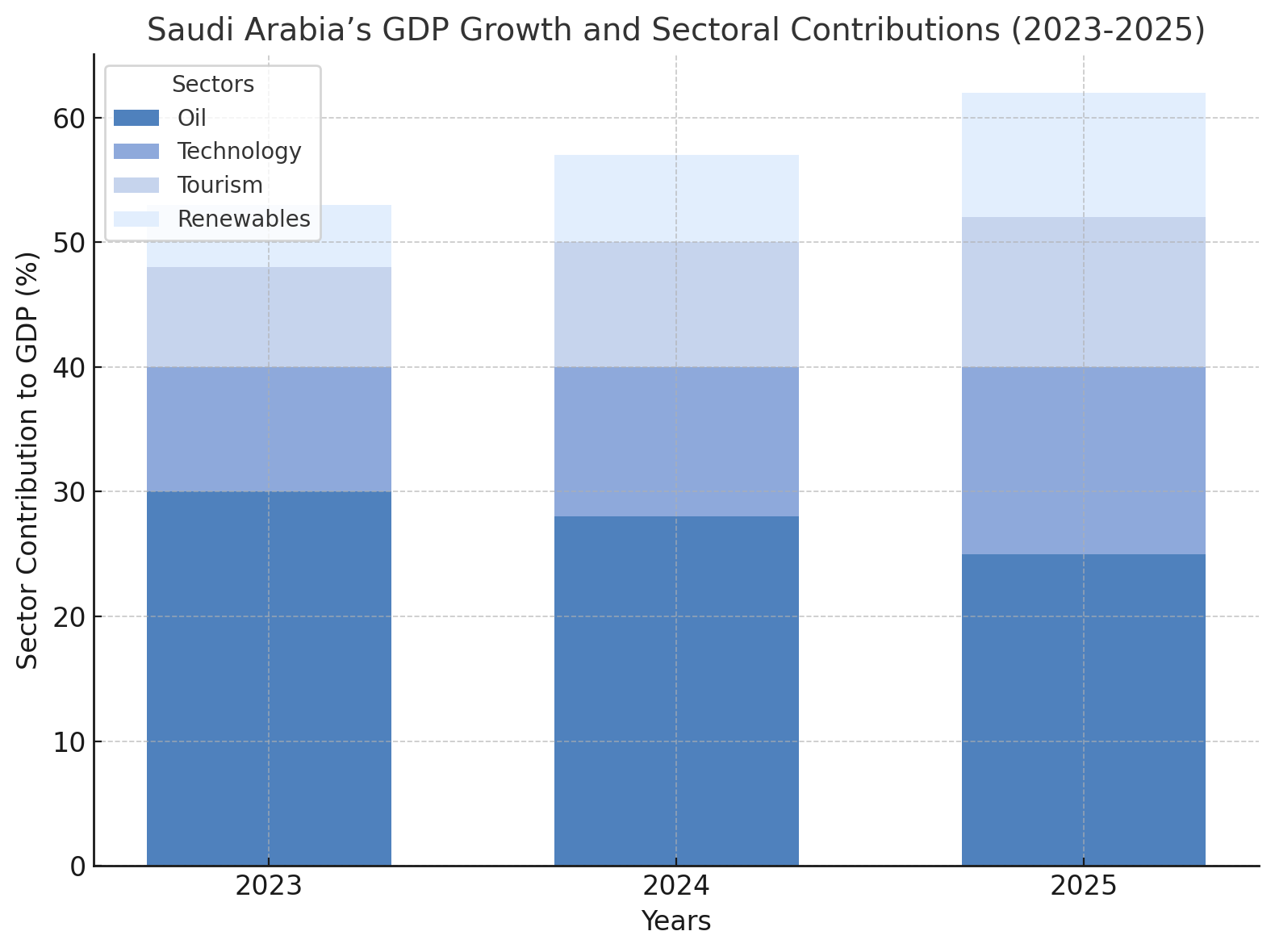

Saudi Arabia’s economy is undergoing a significant transformation, with Vision 2030 driving diversification and economic resilience. In 2024, the Kingdom achieved GDP growth of 4.8%, with technology, tourism, and renewable energy emerging as key sectors. Non-oil revenue increased by 19%, signaling progress in reducing dependency on oil. However, economic challenges remain, including global oil price volatility, inflation, and regional geopolitical tensions.

Key Statistics:

- Oil Dependency: Despite diversification efforts, oil accounted for 29% of total exports in 2024, down from 35% in 2023.

- Foreign Direct Investment (FDI): FDI inflows reached $22 billion in 2024, a 14% increase compared to the previous year, reflecting growing investor confidence.

- Inflation: Consumer price inflation rose to 3.2% in 2024, driven by higher energy and food prices.

Key Impacts on Businesses:

- Cost Pressures: Rising inflation and currency fluctuations are increasing operational costs for small and medium-sized enterprises (SMEs).

- Export Challenges: Businesses reliant on exports face reduced demand from inflation-hit trading partners.

- Opportunities in Tech: Companies investing in AI, IoT, and digital infrastructure are capitalizing on the Kingdom’s tech-driven initiatives.

Bar chart showing GDP growth rates and contributions from oil, technology, tourism, and renewable energy sectors.

Key Drivers of Market Volatility in Saudi Arabia

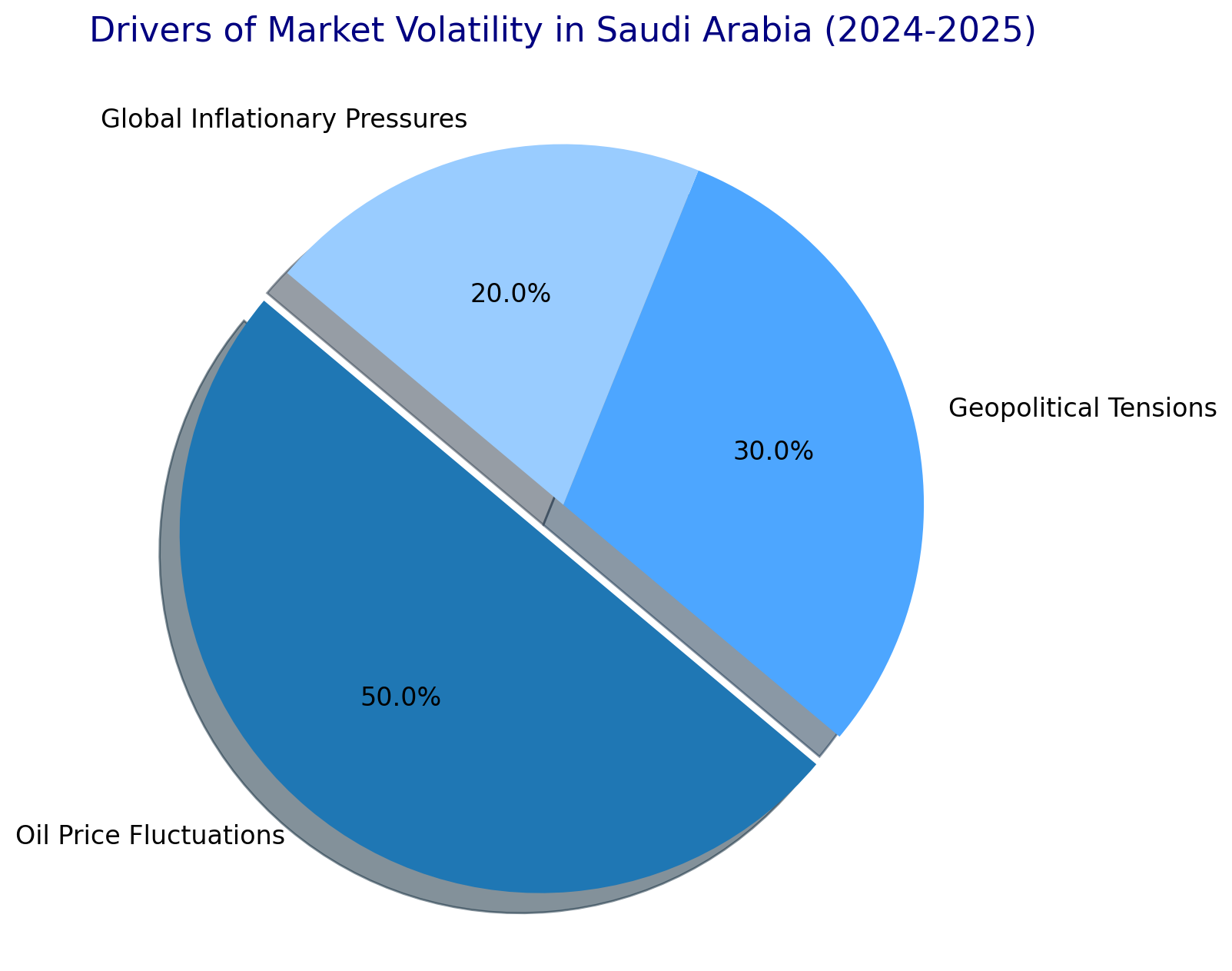

Saudi Arabia’s market volatility is influenced by a combination of external and internal factors. As of 2025, businesses in the Kingdom face risks from fluctuating oil prices, geopolitical uncertainty, and inflationary pressures.

Oil Price Fluctuations

Oil remains a key pillar of Saudi Arabia’s economy despite diversification efforts. Brent crude oil prices fluctuated between $70 and $85 per barrel in 2024. These price swings are driven by global supply-demand imbalances and geopolitical factors. The energy sector’s dependency on such volatile markets significantly impacts related industries like construction and logistics.

Key Impact:

- Fluctuations in oil prices contributed to a 7% variability in corporate profit margins for energy-reliant businesses in 2024.

- 45% of SMEs in Saudi Arabia reported increased operational costs linked to fuel price hikes.

Geopolitical Tensions

Regional geopolitical tensions in the Middle East continue to affect investor confidence. Trade routes and supply chains are often disrupted by these instabilities, leading to higher logistics costs and delayed shipments.

Key Data:

- A 2024 study showed that geopolitical events accounted for 12% of supply chain delays in Saudi Arabia.

- Foreign investment in high-risk areas of the region dropped by 8% compared to 2023.

Global Inflationary Pressures

Inflation in key trading partners such as the EU, the US, and China has led to higher costs of imported goods. This global inflation ripple effect has increased costs for local businesses and reduced purchasing power among consumers.

Key Data:

- Import costs rose by 5.3% in 2024, impacting sectors like manufacturing and retail.

- Domestic inflation in Saudi Arabia reached 3.2% in 2024, up from 2.8% in 2023.

Pie chart showing the contributions of oil price fluctuations, geopolitical tensions, and global inflationary pressures to overall market volatility.

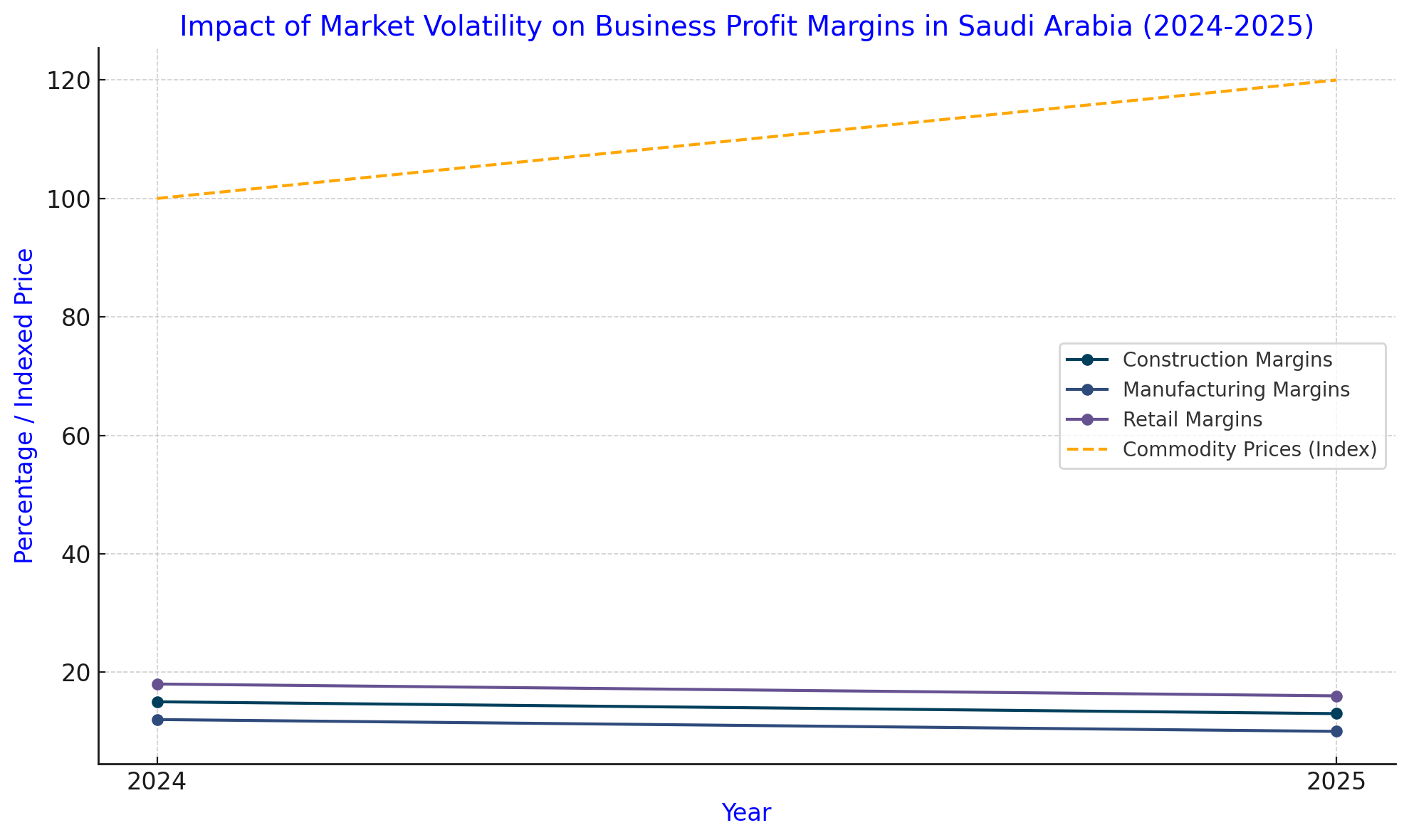

Warning Sign 1: Market Volatility Impacting Profitability

Market volatility continues to be a pressing challenge for businesses in Saudi Arabia, especially as the Kingdom diversifies its economy. Oil price fluctuations and global economic trends have a direct impact on profitability across various sectors, creating uncertainty for businesses striving for stable growth.

Impact of Currency Volatility

The Saudi Riyal’s peg to the US dollar offers a measure of stability, but currency volatility in global markets can still influence trade costs. For example, businesses importing raw materials saw a 6% increase in costs in 2024 due to exchange rate disparities between trading partners in Asia and Europe.

Quantitative Data:

- Exchange rate-related losses accounted for 3% of overall operating costs for import-reliant businesses in 2024.

- 47% of exporters in Saudi Arabia reported reduced demand from inflation-impacted foreign markets.

Commodity Price Swings

Sectors such as construction and manufacturing are especially vulnerable to price swings in essential commodities like steel and aluminum. The construction sector faced a 5.2% increase in material costs in 2024 due to global supply chain disruptions and rising input costs.

Quantitative Data:

- The price of imported steel increased by 4.7% year-on-year, adding to the challenges faced by Saudi construction firms.

- Average profit margins in the manufacturing sector decreased by 2% in 2024 due to higher commodity prices.

Strategies to Mitigate Market Volatility

- Hedging Mechanisms: Companies can adopt financial hedging tools to protect against unpredictable price changes in currencies and commodities.

- Example: Businesses in Saudi Arabia using forward contracts saved an estimated 4% on import costs in 2024.

- Revenue Diversification: Expanding into multiple revenue streams reduces dependency on any single sector or region affected by volatility.

- Example: Retail businesses that integrated e-commerce sales saw a 12% increase in revenue despite market uncertainties.

Line graph comparing the fluctuations in commodity prices and average profit margins across sectors like construction, manufacturing, and retail.

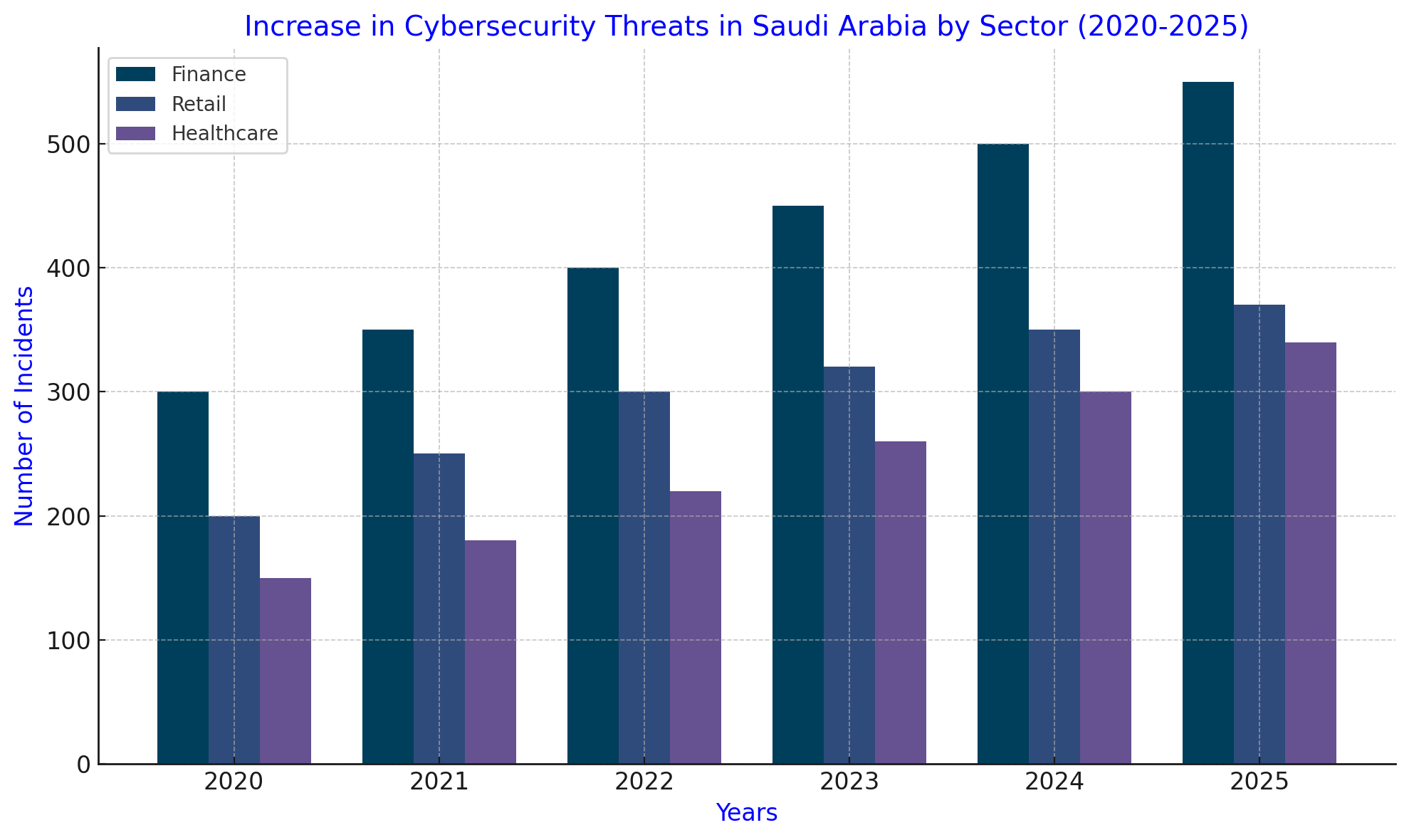

Warning Sign 2: Insufficient Response to Cybersecurity Threats

With Saudi Arabia’s rapid digital transformation, businesses are increasingly exposed to cyber threats. A report by the Saudi National Cybersecurity Authority in 2024 revealed a 22% increase in ransomware attacks targeting the financial and retail sectors. Poor cybersecurity practices not only risk financial losses but also damage a company’s reputation.

Key Risks:

- Data Breaches: Customer data theft can lead to severe regulatory penalties under the Kingdom’s data protection laws.

- Operational Downtime: Cyberattacks can disrupt essential business operations.

Mitigation Strategies:

- Invest in advanced cybersecurity solutions, such as AI-driven threat detection systems.

- Conduct regular employee training sessions to identify phishing attempts and other vulnerabilities.

Insights KSA recommends prioritizing IT resilience to safeguard critical business assets.

Bar chart showing the number of incidents in finance, retail, and healthcare sectors.

Warning Sign 3: Inefficient Supply Chain and Operational Risks

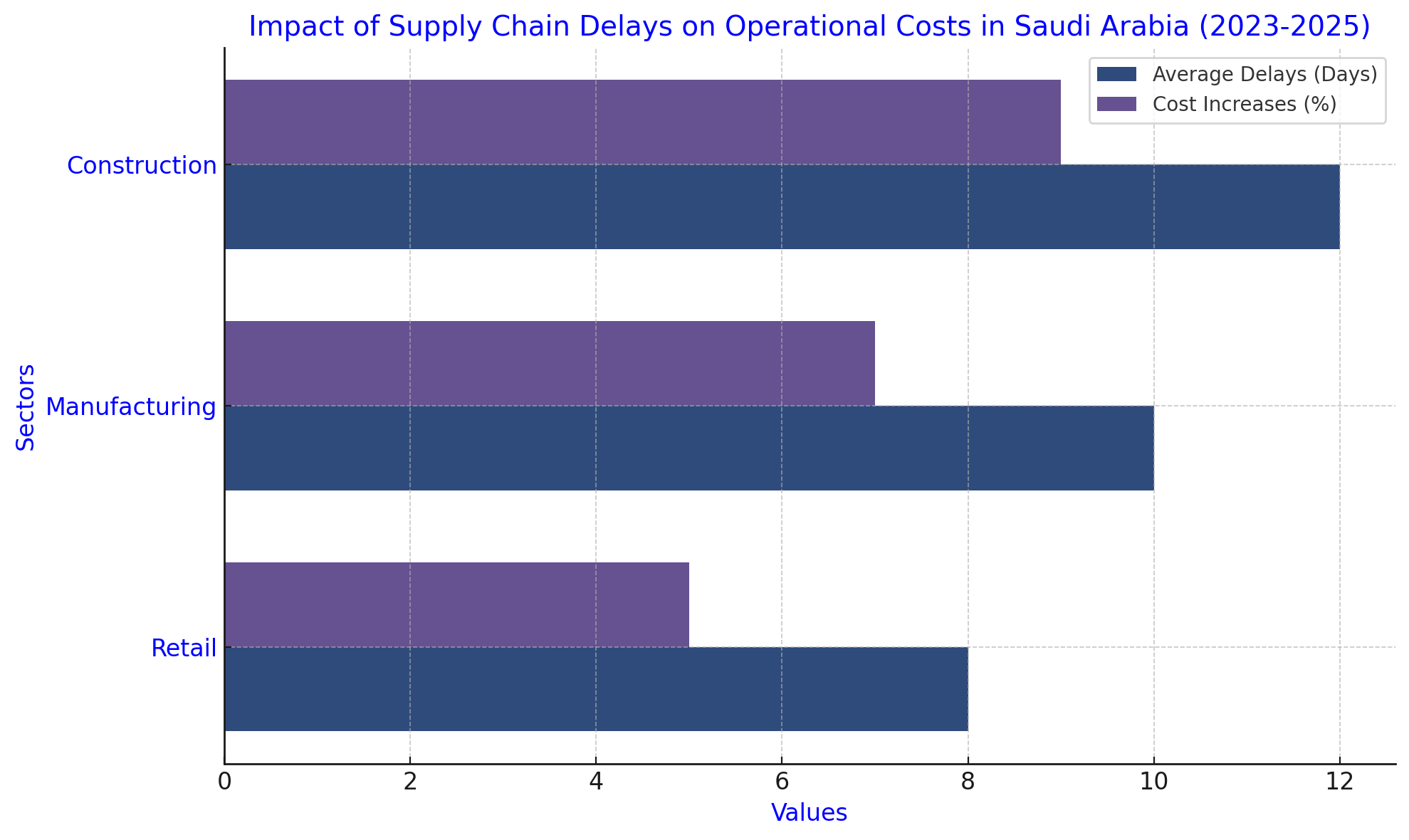

Saudi Arabia’s strategic geographic location positions it as a global trade hub. However, businesses continue to face operational risks due to supply chain disruptions, logistics inefficiencies, and workforce challenges. These issues were exacerbated by the global economic slowdown and geopolitical uncertainties in 2024, making supply chain resilience a key concern for businesses in 2025.

Logistics Delays

Congestion at Saudi Arabia’s key ports, including Jeddah Islamic Port and King Abdulaziz Port, caused shipment delays averaging 8-10 days in 2024. This delay had ripple effects on industries such as retail, construction, and manufacturing.

Quantitative Data:

- The Saudi Ports Authority reported a 12% increase in shipment delays compared to 2023.

- Businesses dependent on just-in-time supply chains faced a 5% increase in operational costs due to delayed raw materials.

Dependency on Single Suppliers

Over-reliance on specific vendors, especially in sectors such as electronics and automotive, has left businesses vulnerable to disruptions in the global supply chain. In 2024, disruptions in semiconductor supply chains resulted in production halts for several Saudi manufacturers.

Quantitative Data:

- 37% of manufacturers reported at least one production stoppage in 2024 due to supplier delays.

- Dependency on single suppliers increased overall procurement costs by 4.5% year-on-year.

Workforce Productivity Issues

Operational risks extend to workforce management challenges, including labor shortages and skill gaps. A 2024 survey revealed that 48% of businesses struggled to find skilled labor for logistics and supply chain roles, impacting efficiency.

Mitigation Strategies

- Diversifying Supply Chains: Businesses should source from multiple vendors to reduce reliance on a single supplier.

- Example: Companies that diversified their supply chains reduced delays by an average of 15% in 2024.

- Investing in Technology: Real-time supply chain visibility tools, including IoT-enabled tracking, help businesses predict and mitigate delays.

- Workforce Training: Upskilling employees in logistics and supply chain management can improve overall operational efficiency.

Horizontal bar chart comparing average delays and cost increases across retail, manufacturing, and construction sectors.

The Importance of Financial Metrics

Effective financial metrics like profit margins and cash flow are indispensable for market risk management. 68% of Saudi businesses cited cash flow management as their top challenge in risk mitigation. Companies that fail to maintain financial discipline risk insolvency during periods of economic uncertainty.

Actionable Steps:

- Conduct regular financial audits to identify weaknesses in balance sheets.

- Use predictive analytics to forecast cash flow needs during market disruptions.

Technology Risks and Cybersecurity Concerns

Saudi Arabia’s digital transformation initiatives have elevated the country as a technological hub. However, this growth comes with heightened exposure to cybersecurity threats.

Preventative Measures:

- Implement robust encryption protocols and multi-factor authentication.

- Regularly update systems to address vulnerabilities.

Customer Behavior Trends in Saudi Arabia

Consumer preferences in the Kingdom are shifting rapidly, influenced by digital adoption and increased spending power. Businesses must adapt to these changes by prioritizing personalization and loyalty programs.

Insights:

- Focus on digital engagement strategies.

- Leverage data analytics to predict and respond to changing customer demands.

The Role of Market Risk Management in Saudi Arabia’s Vision 2030

Saudi Arabia’s Vision 2030 sets ambitious goals for economic diversification, sustainability, and technological innovation, positioning the Kingdom as a global business hub. However, achieving these objectives requires businesses to adopt robust market risk management strategies to navigate the challenges of a dynamic and often unpredictable market environment.

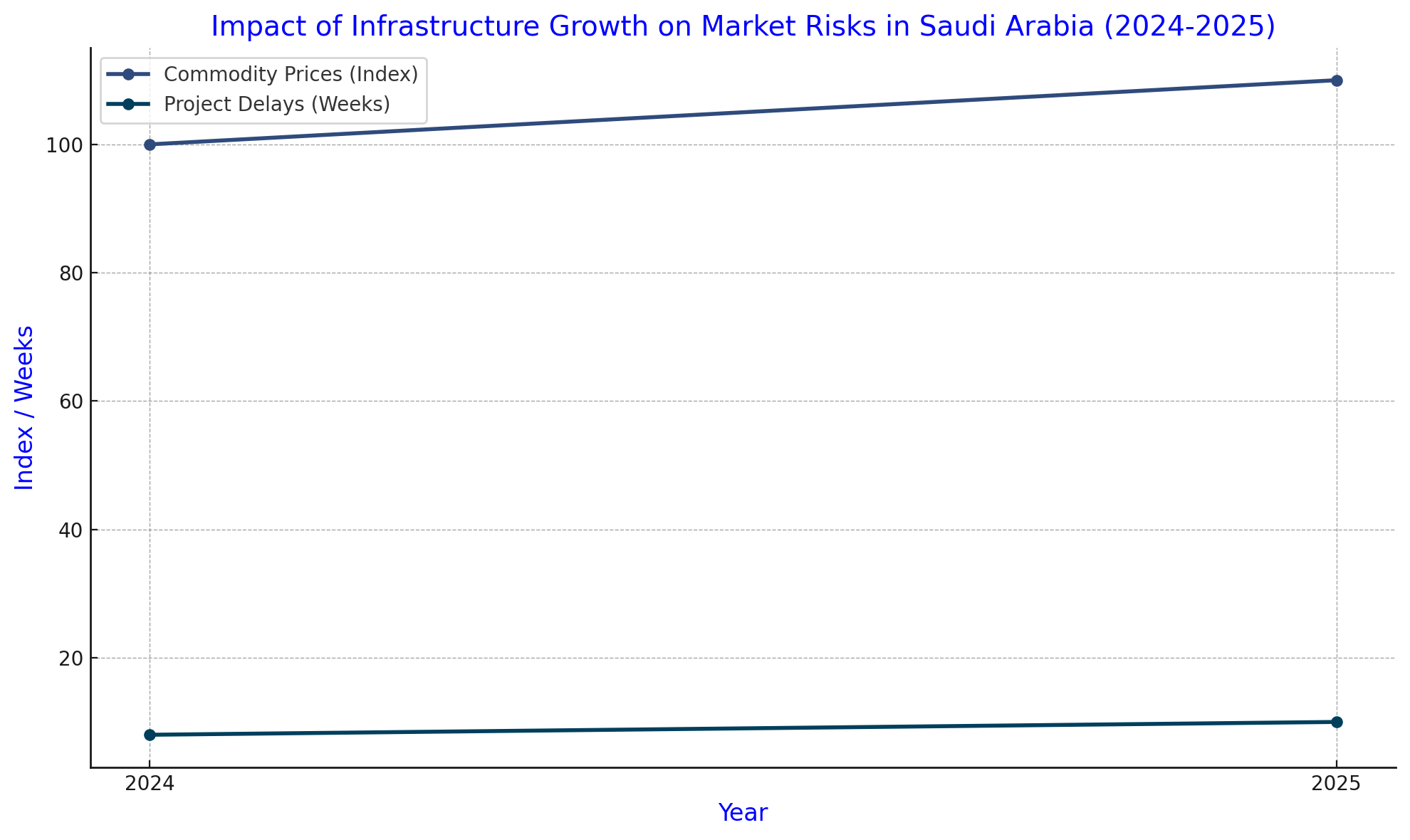

Infrastructure Expansion and Supply Chain Resilience

With megaprojects like NEOM and The Red Sea Project underway, infrastructure investments are driving economic growth. However, these projects are highly sensitive to market volatility, including commodity price fluctuations and logistical inefficiencies.

Quantitative Data:

- Construction costs increased by 4.3% in 2024 due to higher steel and cement prices.

- Logistic inefficiencies contributed to a 5% delay in project timelines across major initiatives.

Line chart showing correlations between commodity prices and project delays.

Sustainability Goals and ESG Integration

As part of Vision 2030, Saudi Arabia is integrating environmental, social, and governance (ESG) principles into its economic framework. Businesses that fail to align with these standards risk falling behind competitors and losing access to key markets.

Quantitative Data:

- The Saudi Stock Exchange (Tadawul) saw a 15% increase in ESG-compliant listings in 2024.

- 42% of global investors now prioritize ESG metrics when assessing businesses in Saudi Arabia.

Actionable Strategy: Adopting ESG reporting frameworks and transitioning to renewable energy sources can help mitigate risks and attract international investment.

Technology Adoption and Cybersecurity

Vision 2030 emphasizes technological innovation, with significant investments in AI, IoT, and cloud computing. However, rapid digital transformation increases exposure to cyber threats and technological failures.

Quantitative Data:

- Cybersecurity incidents in Saudi Arabia’s tech sector rose by 20% in 2024, highlighting vulnerabilities in emerging technologies.

- Businesses that adopted AI-driven cybersecurity solutions reduced breach risks by 35%.

Bar chart comparing the rise in cybersecurity threats against mitigation rates achieved through AI tools.

Enhancing Workforce Skills for Risk Management

To align with Vision 2030, businesses must develop a workforce capable of managing market risks effectively. This includes upskilling employees in areas like data analytics, financial forecasting, and strategic planning.

Quantitative Data:

- 63% of surveyed businesses in 2024 identified skill gaps in risk management as a barrier to achieving Vision 2030 goals.

- Companies investing in workforce training saw a 22% improvement in risk mitigation capabilities.

Insights KSA underscores that aligning risk management strategies with Vision 2030 goals will create a competitive edge for businesses in the Kingdom.

How Insights KSA Can Help

Insights KSA is committed to empowering Saudi businesses with comprehensive solutions for navigating market risks. With expertise in data analytics, regulatory compliance, and strategic planning, Insights KSA offers tailored services to:

- Conduct in-depth risk assessments to identify vulnerabilities.

- Develop customized financial and operational strategies for long-term resilience.

- Align business goals with Vision 2030 objectives through data-driven decision-making.

Partnering with Insights KSA ensures your organization stays ahead in an increasingly competitive and volatile market.

FAQs

- Why is market risk management important for Saudi businesses? Market risk management helps businesses mitigate financial and operational uncertainties caused by factors such as market volatility, geopolitical events, and regulatory changes. It is essential for ensuring long-term stability and profitability.

- How does Vision 2030 influence market risk management? Vision 2030 encourages diversification and innovation in the Saudi economy. Businesses must adapt to these changes by implementing robust risk management strategies to align with the Kingdom’s ambitious goals.

- What industries are most affected by market volatility in Saudi Arabia? Industries such as energy, construction, and manufacturing are highly affected due to their reliance on commodity prices and global trade dynamics.

- How can Insights KSA assist in mitigating cybersecurity risks? Insights KSA offers advanced cybersecurity solutions, employee training programs, and real-time threat monitoring systems to safeguard businesses from cyber threats.

- What tools can businesses use to improve financial risk management? Predictive analytics, financial audits, and hedging instruments are some of the tool’s businesses can use to mitigate financial risks management effectively.

As Saudi Arabia continues its economic evolution, businesses must embrace proactive market risk management strategies. By addressing warning signs such as market volatility, cybersecurity threats, and operational inefficiencies, companies can safeguard their long-term success.

Insights KSA advises organizations to focus on adaptability, data-driven decision-making, and resilience to thrive in an unpredictable 2025. Whether through robust financial planning or cutting-edge technology adoption, managing risks effectively is the cornerstone of sustainable growth in the Kingdom.

In this transformative era, the ability to anticipate and mitigate risks is not just a competitive advantage—it’s a necessity. Make 2025 the year your business leads the charge in risk management excellence.

Source Links

- https://insightss.co/blogs/role-of-risk-management-in-saudi-arabia/

- https://investsaudi.sa/medias/Performance-of-Saudi-Arabia-in-Key-Economic-and-Investment-Indicators-March-2024-english.pdf

- https://insightss.co/blogs/risk-management-in-a-volatile-market/

- https://openbusinessinsaudiarabia.com/blog/saudi-arabia-vision-2030/

- https://lucidityinsights.com/articles/saudi-arabias-economic-outlook-towards-2024

- https://www.reuters.com/world/middle-east/saudi-arabias-growth-this-year-marred-by-lower-longer-oil-output-2024-07-22/

- https://www.reuters.com/world/middle-east/moodys-upgrades-saudi-arabias-rating-economic-diversification-efforts-2024-11-22/