In the evolving landscape of corporate governance, environmental, social, and governance (ESG) risk management has become a cornerstone for sustainable business operations. For leaders in Saudi Arabia, understanding and implementing advanced ESG risk management solutions is critical to meeting both global and regional expectations.

This guide delves into the strategies, frameworks, and tools available for effective ESG risk management, focusing on the latest trends and practices for 2024-2025 to coping with ESG risk and compliance.

What is ESG Risk Management?

ESG risk management is the process of identifying, assessing, and mitigating risks related to environmental, social, and governance factors. Companies utilize ESG risk management solutions to safeguard their operations, align with stakeholder expectations, and comply with regulatory requirements.

Key Challenges in ESG Risk Management

- Data Collection and Analysis

- Accurate ESG data collection remains a challenge for many organizations.

- 2024 Insight: 45% of companies in Saudi Arabia cite inconsistent data as a major hurdle.

- Regulatory Compliance

- Compliance with global and local ESG standards, such as those outlined in Vision 2030, adds complexity.

- Projection: Saudi Arabia’s ESG-related regulatory frameworks are expected to increase by 20% by 2025.

- Climate-Related Risks

- Environmental factors like climate change pose significant risks to industries such as oil and gas.

- Stat: 70% of companies globally are incorporating climate-related risk scenarios into their strategic planning (2024).

Advanced ESG Risk Management Solutions

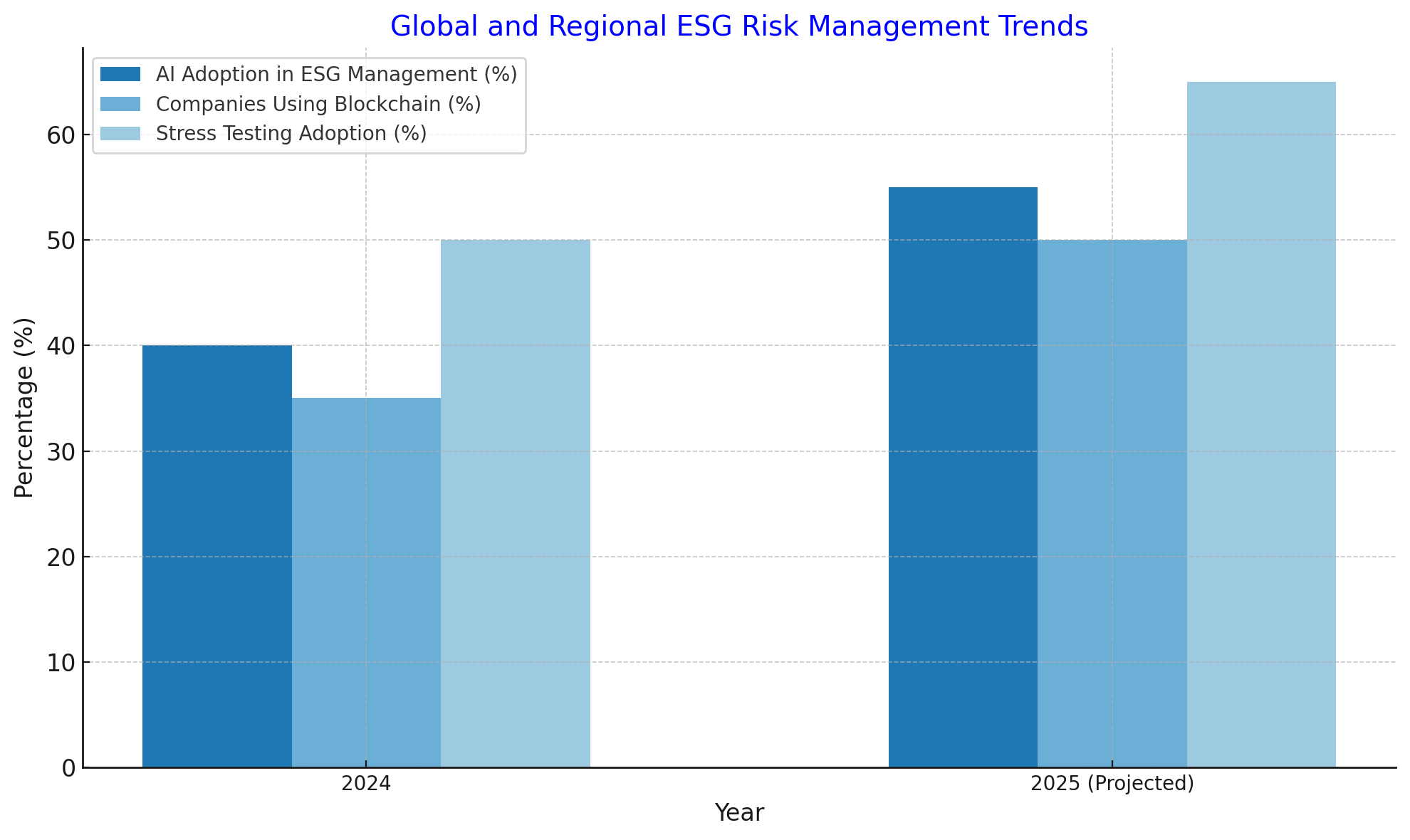

- AI-Powered Risk Assessment Tools

AI and machine learning enable companies to:

- Analyze vast amounts of ESG data in real-time.

- Predict and mitigate potential risks with greater accuracy.

Case Study: Saudi Oil Sector

- 2024: The adoption of AI tools reduced environmental risk incidents by 25% in the oil and gas sector.

- Blockchain for Transparent ESG Reporting

Blockchain technology ensures:

- Immutable and transparent ESG data records.

- Improved stakeholder trust and regulatory compliance.

- Scenario Analysis and Stress Testing

Leaders use scenario analysis to:

- Assess the financial impact of various ESG risk scenarios.

- Develop robust mitigation strategies.

Latest Data: By 2025, 60% of Saudi corporations plan to integrate stress testing for climate risks into their risk management frameworks.

Saudi Arabia’s Vision 2030 and ESG Risk Management

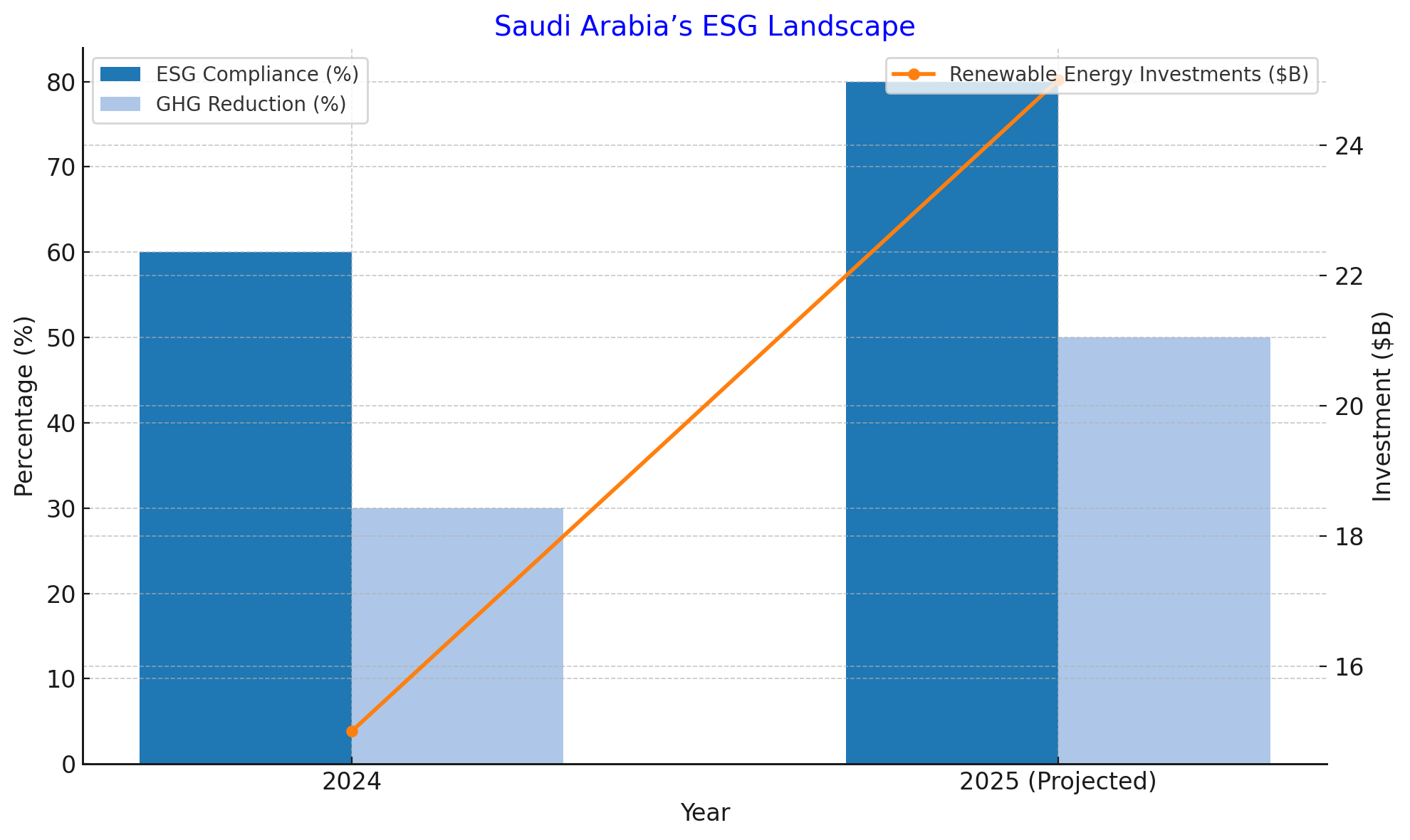

Saudi Arabia’s Vision 2030 emphasizes sustainability as a core objective, urging companies to:

- Adopt global best practices in ESG risk management.

- Invest in renewable energy and sustainable technologies.

Key Milestones:

- Green Saudi Initiative: Targeting a 50% reduction in carbon emissions by 2030.

- NEOM: The $500 billion smart city project incorporates cutting-edge ESG risk management solutions.

Global and Regional ESG Risk Management Trends

Saudi Arabia’s ESG Landscape

Emerging ESG Technologies Transforming Risk Management

Emerging technologies are reshaping the ESG risk management landscape by offering advanced capabilities to address complex challenges. Innovations such as artificial intelligence (AI), blockchain, and Internet of Things (IoT) are enabling organizations to make data-driven decisions and proactively manage ESG risks.

For example, IoT sensors are increasingly used to monitor environmental factors like carbon emissions and water usage in real time. The global IoT market for ESG applications is projected to grow to $18 billion by 2025, driven by increased adoption in energy-intensive industries. In Saudi Arabia, NEOM has implemented IoT solutions to achieve its sustainability goals, showcasing a regional commitment to leveraging cutting-edge technologies.

Integrating ESG into Financial Risk Models

ESG risk management is evolving beyond compliance into the domain of financial modeling. Organizations now integrate ESG considerations into risk-adjusted return models to assess the long-term viability of investments. By 2024, over 75% of global asset managers are expected to incorporate ESG criteria into their investment strategies.

Saudi Arabia’s financial sector is rapidly aligning with global standards. The Saudi Investment Fund (PIF) plans to allocate up to $30 billion in ESG-aligned investments by 2025, reflecting a robust shift toward sustainable finance. This trend highlights the growing recognition of ESG factors as critical to financial performance and stability.

Regional ESG Benchmarking and Performance Metrics

Regional benchmarking plays a vital role in understanding the effectiveness of ESG risk management and compliance. In the Middle East, Saudi Arabia leads with initiatives like the Saudi Exchange ESG Index, which measures the sustainability performance of listed companies. The index evaluates metrics such as emissions reductions, diversity, and community engagement.

As of 2024, the Saudi Exchange ESG Index recorded a 12% improvement in overall sustainability scores compared to the previous year. Projections suggest further enhancements, with companies aiming for a 20% reduction in carbon intensity by 2025. These benchmarks enable businesses to track their progress while fostering healthy competition across industries.

Climate Risk Hedging: A Proactive ESG Approach

Climate risk is one of the most critical components of ESG risk management, necessitating forward-thinking strategies. Companies are increasingly adopting climate risk hedging to mitigate potential adverse impacts on their operations. This involves financial instruments like green bonds and sustainability-linked loans, as well as physical measures like renewable energy investments.

In Saudi Arabia, green bond issuance reached $2 billion in 2024, and this figure is projected to grow by 50% in 2025. Additionally, 35% of organizations in energy-intensive sectors have incorporated climate risk hedging into their overall risk management strategies.

Governance Risks: Addressing Ethical and Compliance Concerns

Governance-related risks, including corruption, ethical misconduct, and regulatory violations, pose significant challenges for companies striving to maintain ESG compliance. To address these issues, organizations are implementing advanced governance frameworks and adopting technologies that promote transparency.

For example, in 2024, 65% of Saudi-listed companies established dedicated ESG governance committees. This trend is expected to continue, with a projected 80% compliance rate by 2025. Enhanced oversight mechanisms, such as whistleblower programs and anti-corruption initiatives, are also gaining traction.

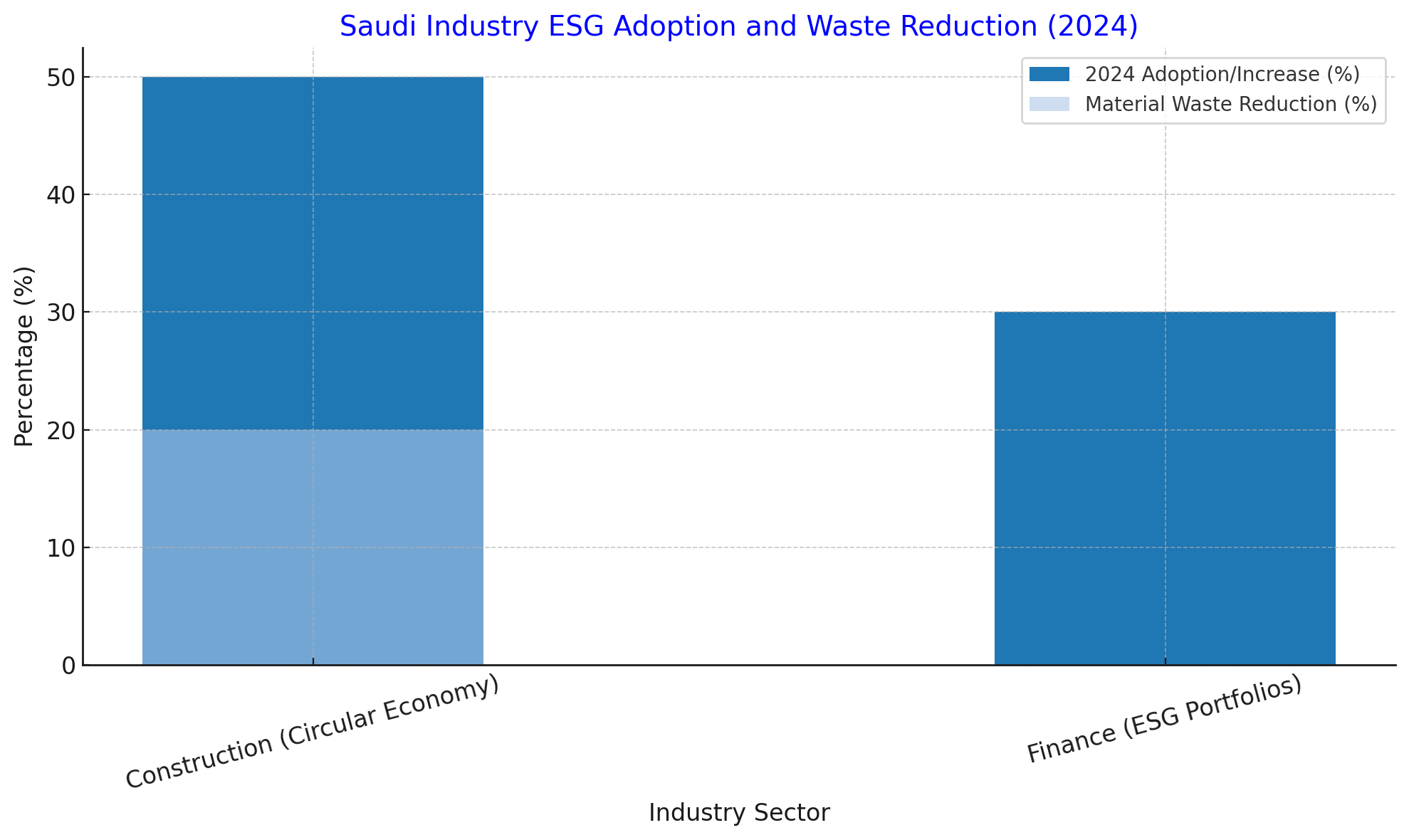

Industry-Specific ESG Risk Management in Saudi Arabia

Different industries face unique ESG risks, and tailoring solutions to sector-specific needs is essential. In the construction sector, sustainable material sourcing and waste management are key focus areas. By contrast, in the finance sector, risks revolve around sustainable investing and aligning portfolios with ESG principles.

In 2024, 50% of Saudi construction companies adopted circular economy principles, reducing material waste by 20%. Meanwhile, the finance sector saw a 30% increase in ESG-aligned investment portfolios. These trends highlight the importance of industry-specific approaches in mitigating ESG risks effectively.

ESG Collaboration Across the Supply Chain

Supply chain dynamics play a crucial role in ESG performance, particularly for industries with complex global operations. Collaboration across the supply chain ensures that sustainability goals are met at every level, from sourcing raw materials to final production.

In Saudi Arabia, 40% of manufacturing firms implemented supply chain ESG audits in 2024, with a projected increase to 55% by 2025. These audits help identify weak points and improve overall sustainability, fostering stronger relationships with stakeholders and partners.

How Insights KSA Can Help

Insights KSA provides a suite of advanced ESG risk management solutions tailored to the Saudi Arabian market. Here’s how:

- Customized Risk Assessments: Leveraging data analytics to identify and mitigate specific ESG risks.

- Regulatory Compliance Support: Ensuring adherence to local and global ESG standards, including Vision 2030 mandates.

- Training and Stakeholder Engagement: Building capacity within organizations to address ESG challenges effectively.

FAQs

- What is the role of AI in ESG risk management? AI enables real-time data analysis, predictive modeling, and automated reporting, significantly improving the accuracy and efficiency of ESG risk management.

- How does ESG risk management impact financial performance? Effective ESG risk management minimizes operational risks, enhances reputation, and attracts sustainable investments, leading to improved financial outcomes.

- What tools are essential for ESG risk management in 2024-2025? Key tools include AI-driven ESG risk assessment platforms, blockchain for transparent reporting, and stress testing frameworks.

- Why is ESG risk management crucial in Saudi Arabia? With Vision 2030 emphasizing sustainability, ESG risk management ensures regulatory compliance, competitiveness, and alignment with national objectives.

- How can Insights KSA support my organization? Insights KSA offers end-to-end ESG risk management solutions, with customized assessments, ensuring your organization meets its sustainability goals.

Advanced ESG risk management solutions are essential for leaders seeking to navigate the complexities of modern business landscapes. By leveraging technology, aligning with global standards, and focusing on sustainability, businesses in Saudi Arabia can position themselves for long-term success.

Partnering with experts like Insights KSA ensures that your ESG risk management strategy is robust, effective, and aligned with Vision 2030 objectives.

Sources