ESG consulting companies are at the forefront of transforming how businesses operate in an era of heightened scrutiny and evolving regulations. However, as ESG shifts from buzzword to baseline, these consulting firms are grappling with some pretty daunting obstacles. Buckle up, because we’re diving into the four biggest challenges ESG consulting companies face today—along with some spicy solutions to keep them ahead of the curve in 2025 and beyond.

1. Is This the ESG Maze or the Matrix? Navigating Complex Regulatory Landscapes

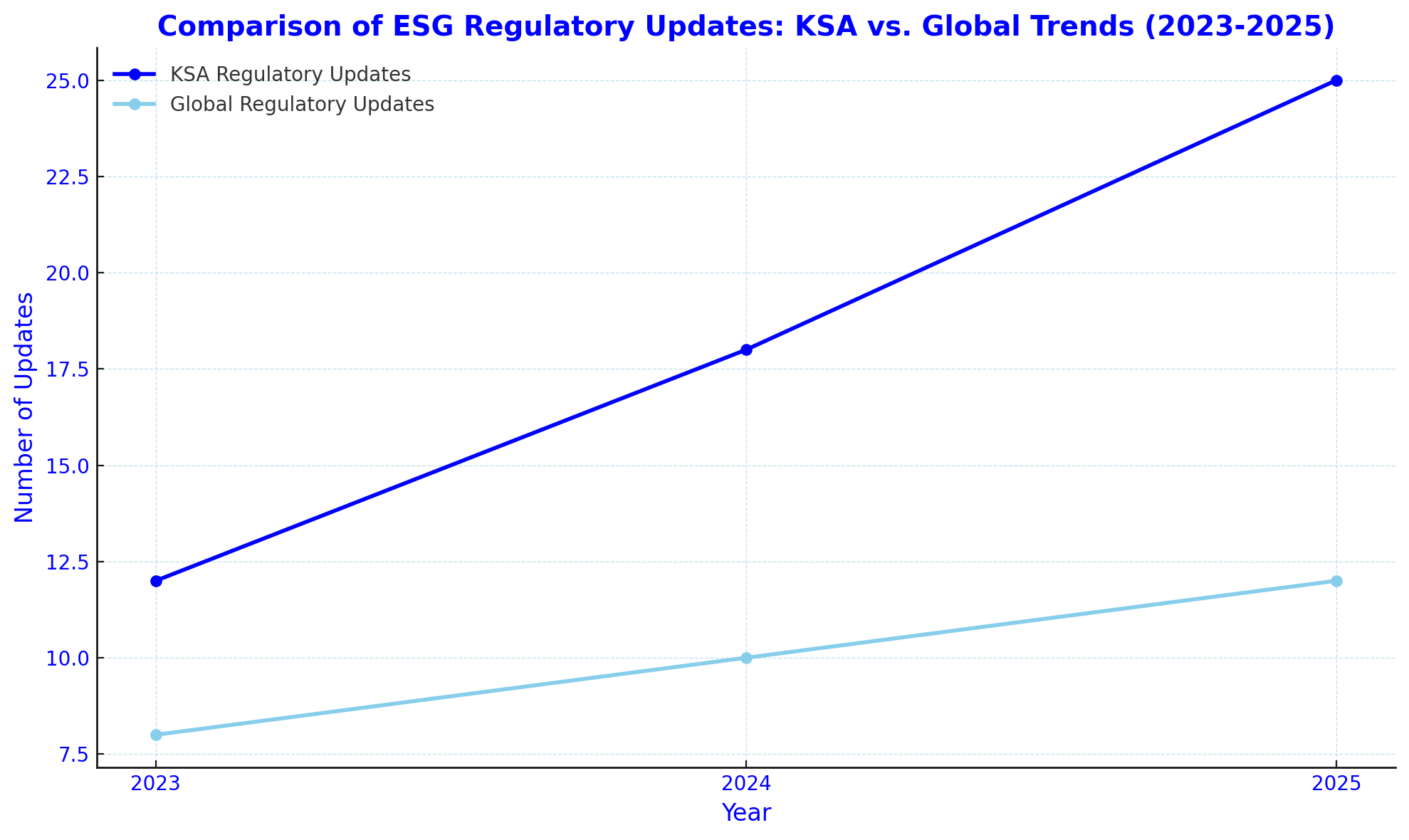

The ESG regulatory environment is becoming increasingly convoluted, especially in the Kingdom of Saudi Arabia (KSA) where Vision 2030 is driving an unprecedented focus on sustainability and governance. Businesses must navigate a mix of local and international frameworks that are constantly evolving. For instance, as of late 2024, a KPMG survey highlighted that 72% of businesses globally are struggling to adapt to ESG reporting standards. In the GCC, 65% of companies report being overwhelmed by overlapping regulations, including the EU’s Corporate Sustainability Reporting Directive (CSRD) and the evolving mandates of the U.S. SEC.

The stakes are particularly high in KSA, where compliance with Vision 2030 goals requires precise alignment with local policies, such as the Saudi Green Initiative, alongside adherence to global standards. Companies find themselves asking, “Do we need a regulatory crystal ball to keep up?” ESG consulting companies face the daunting task of decoding these regulations and enabling businesses to adapt without falling behind.

Enter technology as the savior. ESG consulting firms can deploy AI-driven tools capable of analyzing and adapting to regulatory changes in real time. For example, Insights KSA’s tailored compliance software ensures businesses can seamlessly align with complex regulatory landscapes, freeing up resources for strategic decision-making rather than regulatory firefighting. The key is not just surviving the maze but mastering it.

2. Drowning in Data: Is It a Goldmine or a Landmine? Overcoming Data Overload

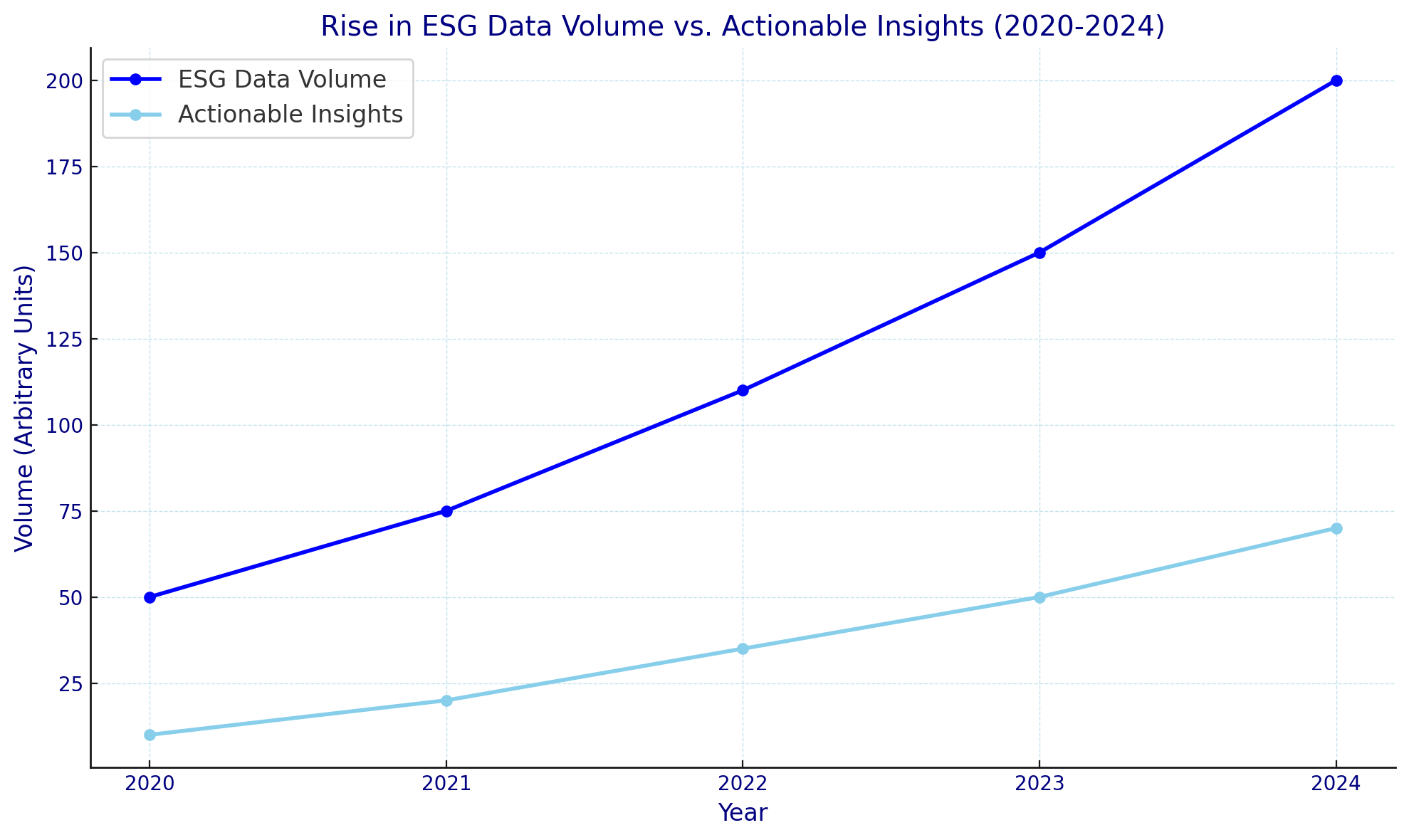

The surge in ESG data is a double-edged sword. While it provides immense potential for insights, the lack of proper integration and analysis often turns this data deluge into an operational nightmare. A 2025 Gartner report highlights a startling prediction: 60% of ESG data initiatives are set to fail due to inadequate integration strategies. In KSA, the stakes are magnified by the nation’s ambitious energy transition goals, which demand precise and actionable metrics.

Businesses frequently face the paradox of being data-rich but insight-poor, gathering vast amounts of information without the analytical capabilities to make sense of it. This issue not only stalls progress but can also lead to decision paralysis, undermining the very essence of ESG goals.

For ESG consulting companies, the solution lies in deploying advanced analytics platforms that integrate machine learning with domain expertise. Insights KSA’s innovative tools are a game-changer in this space. By transforming raw data into clear, actionable insights, these platforms empower organizations to make data-driven decisions tailored to the Kingdom’s unique sustainability challenges. The focus must shift from merely collecting data to translating it into measurable progress, enabling companies to achieve their ESG objectives efficiently.

3. The Greenwashing Grenade: Are We All Just Faking It?

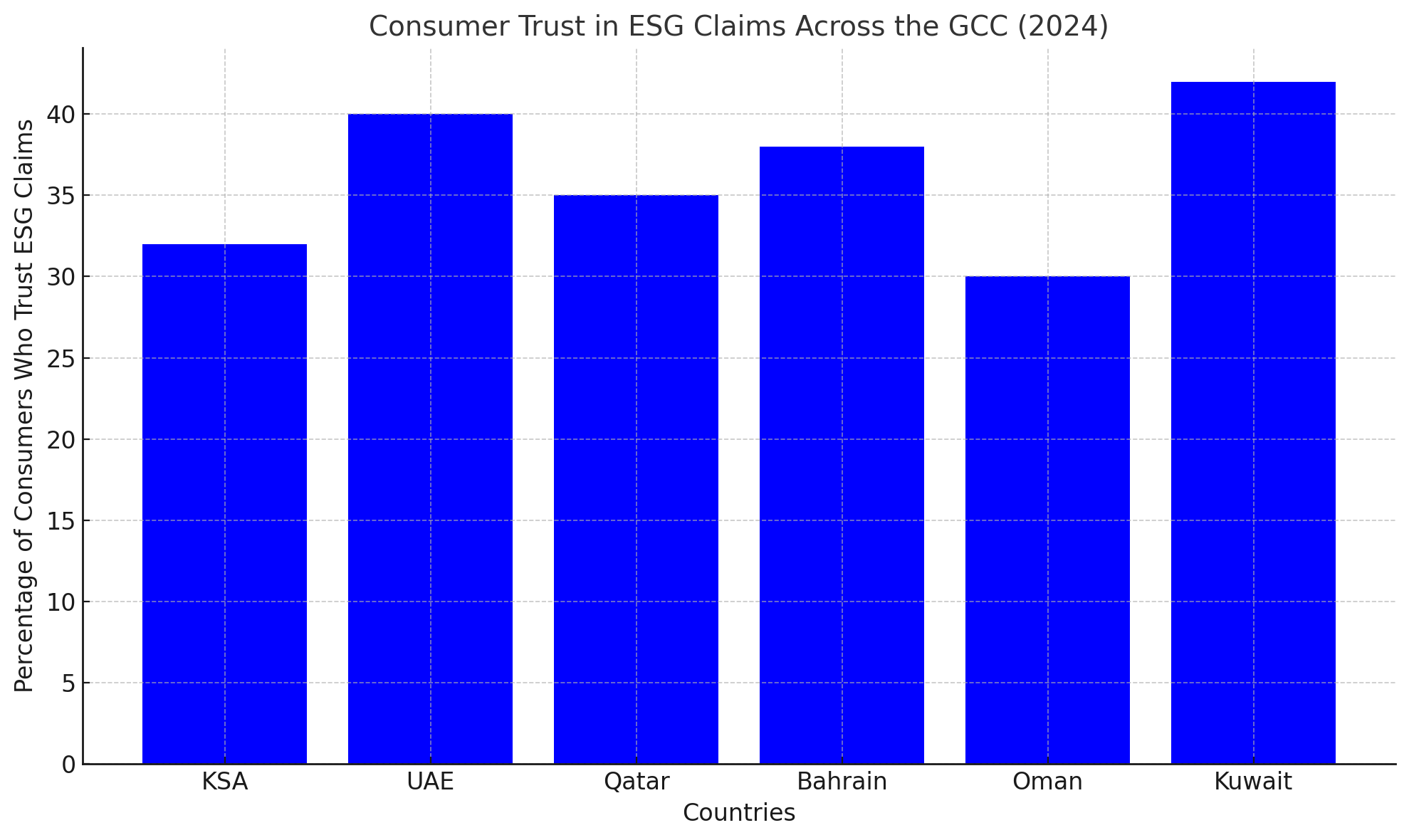

Greenwashing has emerged as a ticking time bomb for corporations, with increasingly savvy consumers calling out insincere sustainability efforts. A 2024 survey by Edelman found that 68% of consumers in the Middle East are skeptical of corporate ESG claims, a figure that climbs even higher in KSA where trust is paramount. This growing mistrust underscores a pressing need for authenticity in sustainability practices.

The prevalence of greenwashing damages corporate reputations and erodes consumer trust, leading stakeholders to question whether businesses are prioritizing optics over outcomes. ESG consulting companies must step in as the arbiters of authenticity. Through rigorous verification processes, they ensure that sustainability initiatives are backed by measurable outcomes, not marketing gimmicks.

Insights KSA exemplifies this approach, offering services that validate ESG claims with transparency and accountability. Their methods include robust impact assessments, third-party audits, and detailed reporting—all designed to restore faith in corporate commitments. By aligning business actions with stated ESG goals, they transform what could be a grenade into a stepping stone for trust and growth.

4. The ESG Talent Tug-of-War: Who Will Win the Sustainability Showdown?

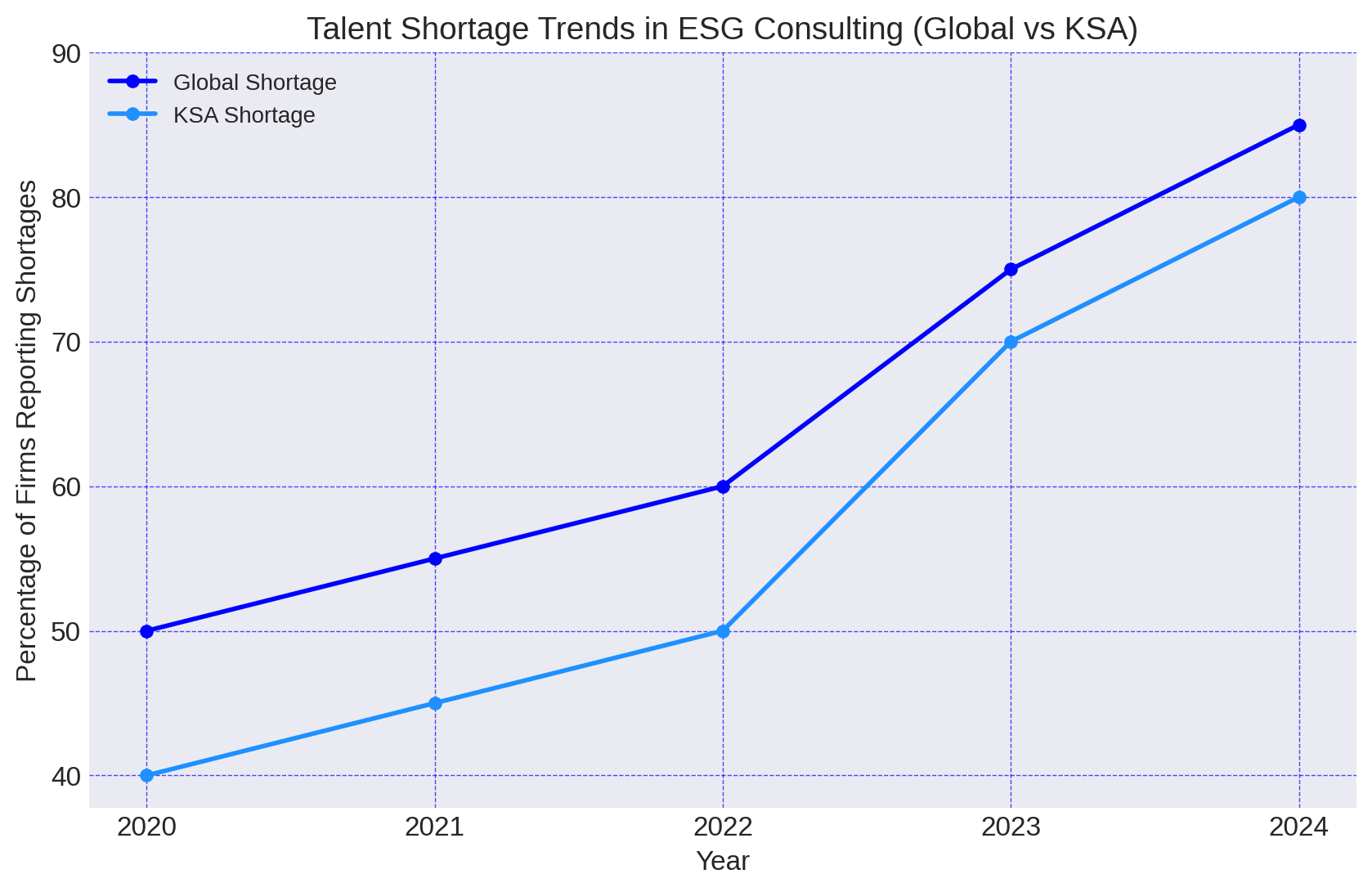

The race to secure ESG talent has intensified, turning into a full-blown tug-of-war as the demand for skilled professionals far outstrips supply. In 2024, a staggering 85% of ESG consulting firms globally reported difficulty finding qualified specialists, with the shortage particularly acute in KSA. The Kingdom’s Vision 2030 initiatives have dramatically increased the demand for ESG expertise, leaving companies scrambling to fill critical roles.

The repercussions of this talent deficit are far-reaching. Overburdened teams risk burnout, while a lack of skilled hires can delay critical ESG projects. In a competitive market, this scarcity of expertise could spell trouble for companies aiming to meet sustainability targets.

The solution lies in proactive talent development. Insights KSA is addressing this challenge head-on by partnering with local universities and professional organizations to design bespoke training programs tailored to the Kingdom’s unique ESG needs. These programs focus on upskilling professionals and nurturing fresh talent, ensuring a steady pipeline of ESG leaders. By investing in education and capacity-building today, companies can secure the workforce needed to drive sustainable growth tomorrow.

Insights KSA’s commitment to fostering talent ensures that the sustainability showdown becomes a win-win for all—empowering organizations while building a robust ESG ecosystem in KSA.

How Insights KSA Can Help You Navigate the ESG Maze

When it comes to ESG, there’s no one-size-fits-all solution. Navigating the ESG maze requires a blend of global insights, local expertise, and cutting-edge technology.

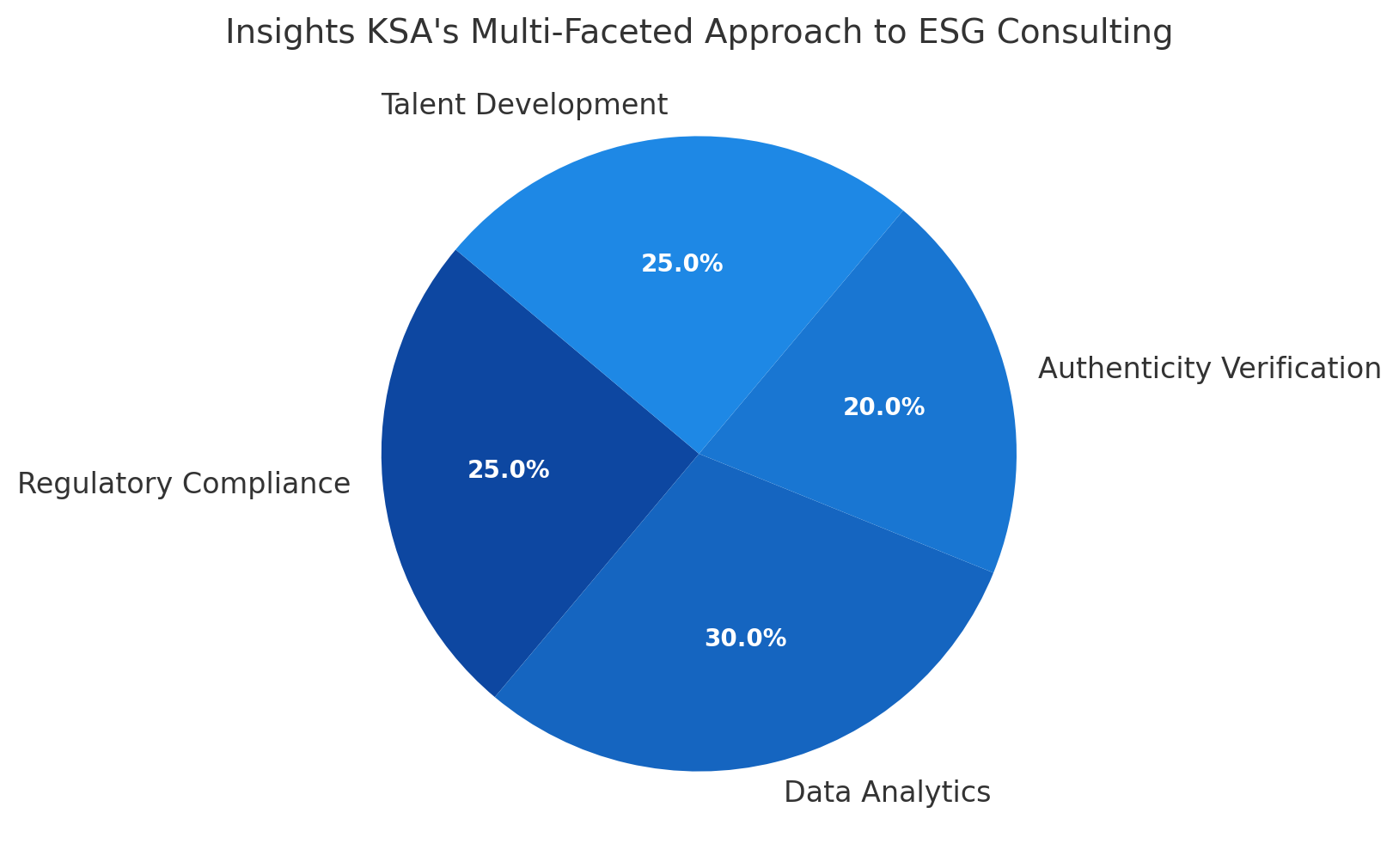

Insights KSA stands out as a comprehensive partner in overcoming these challenges. By decoding regulatory complexities, mastering data analytics, verifying authenticity, and nurturing talent, Insights KSA ensures that businesses not only adapt but thrive in an increasingly sustainability-focused world. The solutions provided by Insights KSA are designed to align with the Kingdom’s Vision 2030, ensuring long-term success in the region.

The challenges facing ESG consulting companies in 2025 are undeniably tough, but they also present unique opportunities for growth and innovation. By embracing advanced technologies, fostering transparency, and investing in talent, these companies can turn obstacles into competitive advantages. With tailored solutions for the KSA market, Insights KSA is leading the charge in making sustainability not just a goal, but a given.

So, what’s your next move? Stay static and watch the race zoom by, or partner with a game-changer like Insights KSA and claim your spot in the ESG Hall of fame. The clock’s ticking, and 2025 is calling.