In the dynamic landscape of private equity, thorough due diligence is the cornerstone of successful investments. For firms operating in Saudi Arabia, understanding the unique regulatory, economic, and cultural nuances is imperative.

Industry Analysis

Understanding the target company’s industry is the first step in the due diligence process. This involves:

- Market Trends: Analyze current and projected trends within the industry.

- Competitive Landscape: Identify key competitors and assess their market positioning.

- Regulatory Environment: Understand industry-specific regulations, especially those pertinent to Saudi Arabia.

In Saudi Arabia, the government has been actively promoting sectors such as renewable energy, healthcare, and technology as part of its Vision 2030 initiative. Investors should evaluate how the target company aligns with these national priorities.

Financial Due Diligence

A meticulous examination of the target’s financial health is crucial. Key components include:

- Historical Financial Statements: Review audited financial statements for the past 3-5 years.

- Quality of Earnings (QoE): Assess the sustainability of earnings by identifying non-recurring items.

- Cash Flow Analysis: Evaluate cash flow patterns to determine liquidity and financial stability.

- Debt Structure: Analyze existing debt obligations and terms.

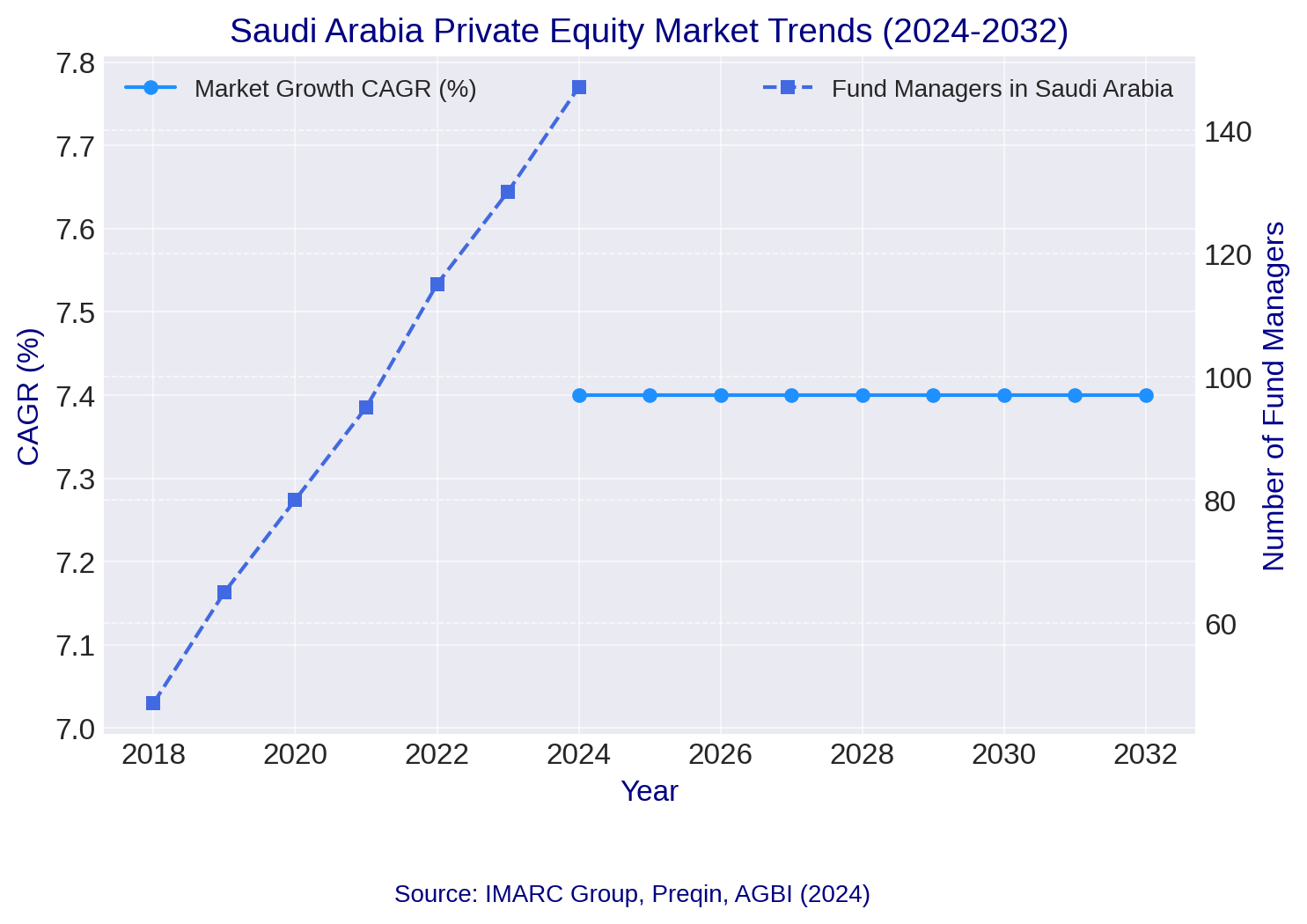

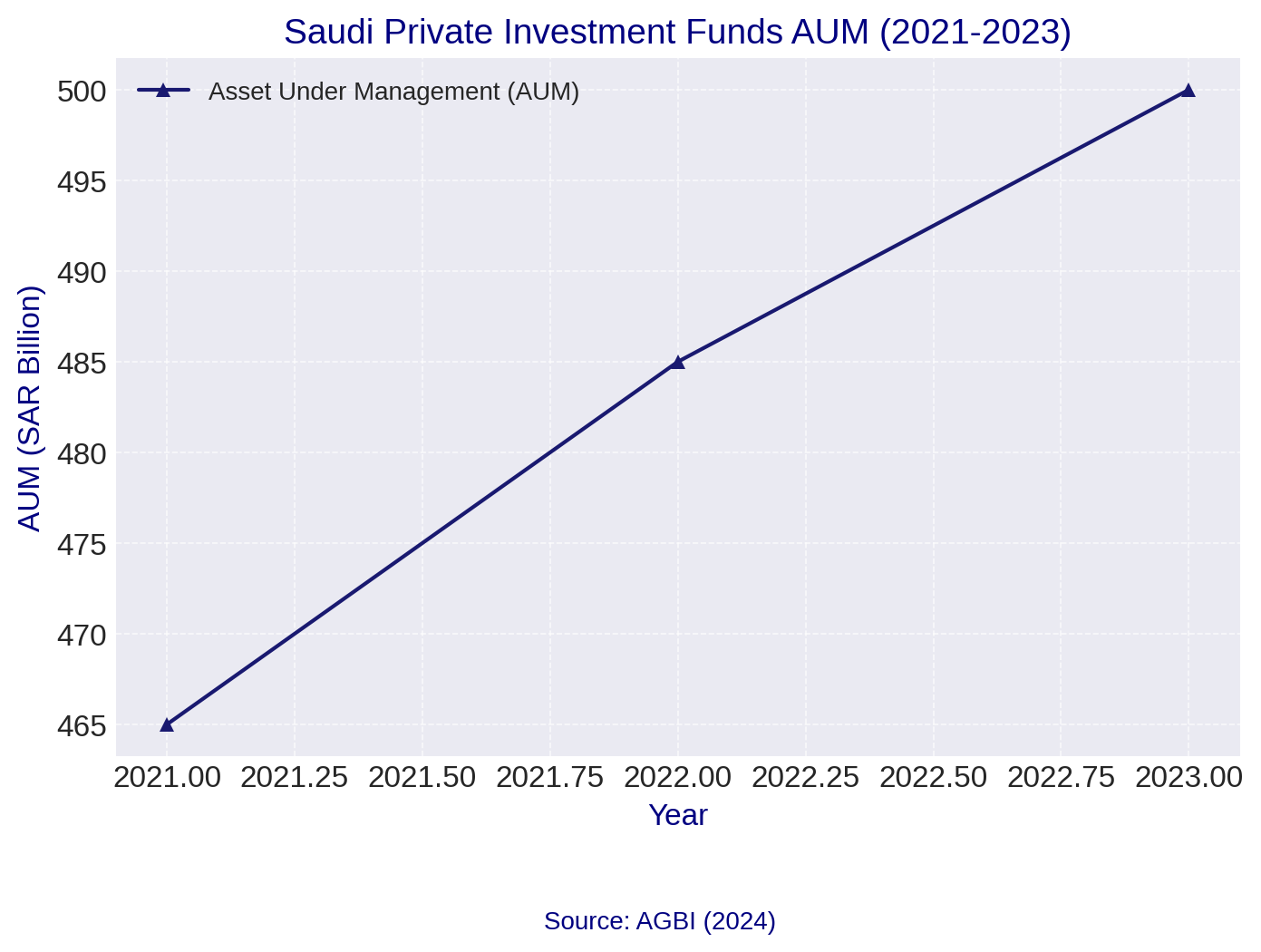

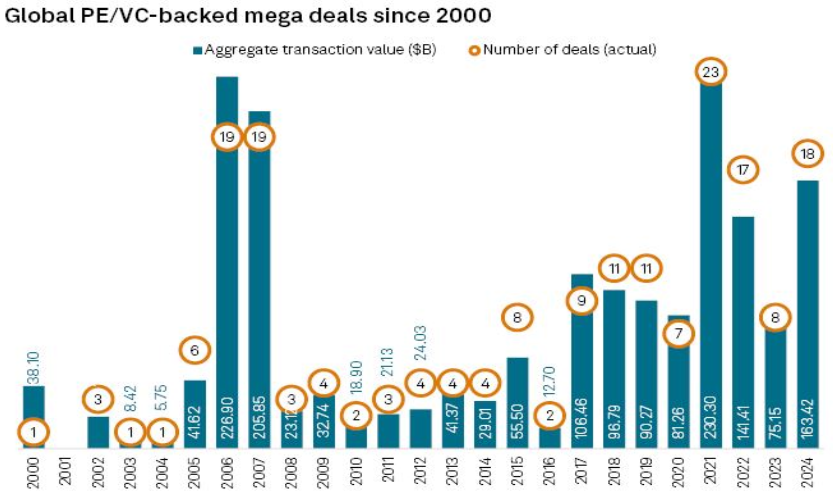

In 2024, private equity firms disclosed over 120 deals exceeding US$195 billion in the second quarter alone, indicating a robust market.

Legal Due Diligence

Legal scrutiny ensures that the investment is sound and free from potential litigations. This involves:

- Corporate Structure: Examine the organizational hierarchy and ownership details.

- Compliance: Verify adherence to local laws, including labor, environmental, and industry-specific regulations.

- Contracts and Agreements: Review all significant contracts with suppliers, customers, and employees.

- Litigation History: Investigate any past or ongoing legal disputes.

Saudi Arabia’s regulatory landscape has evolved significantly, with the Ministry of Investment (MISA) introducing reforms to facilitate foreign investments. Understanding these changes is vital for compliance and strategic planning.

Operational Due Diligence

Assessing the operational aspects provides insights into the company’s efficiency and scalability. Focus areas include:

- Supply Chain Management: Evaluate the robustness and reliability of the supply chain.

- Technology Infrastructure: Assess the adequacy of IT systems and cybersecurity measures.

- Human Resources: Review organizational structure, key personnel, and employee turnover rates.

- Facilities and Equipment: Inspect the condition and suitability of physical assets.

Given the increasing cyber threats globally, cybersecurity due diligence has become non-negotiable. High-profile cyberattacks have underscored the need for rigorous assessments to prevent financial and reputational damage.

Commercial Due Diligence

Understanding the market position and growth potential of the target company involves:

- Customer Base Analysis: Assess customer demographics, satisfaction, and retention rates.

- Market Share: Determine the company’s share in the market and its competitive advantages.

- Sales and Marketing Strategies: Evaluate the effectiveness of current strategies and identify areas for improvement.

- Pricing Models: Analyze pricing strategies in comparison to competitors.

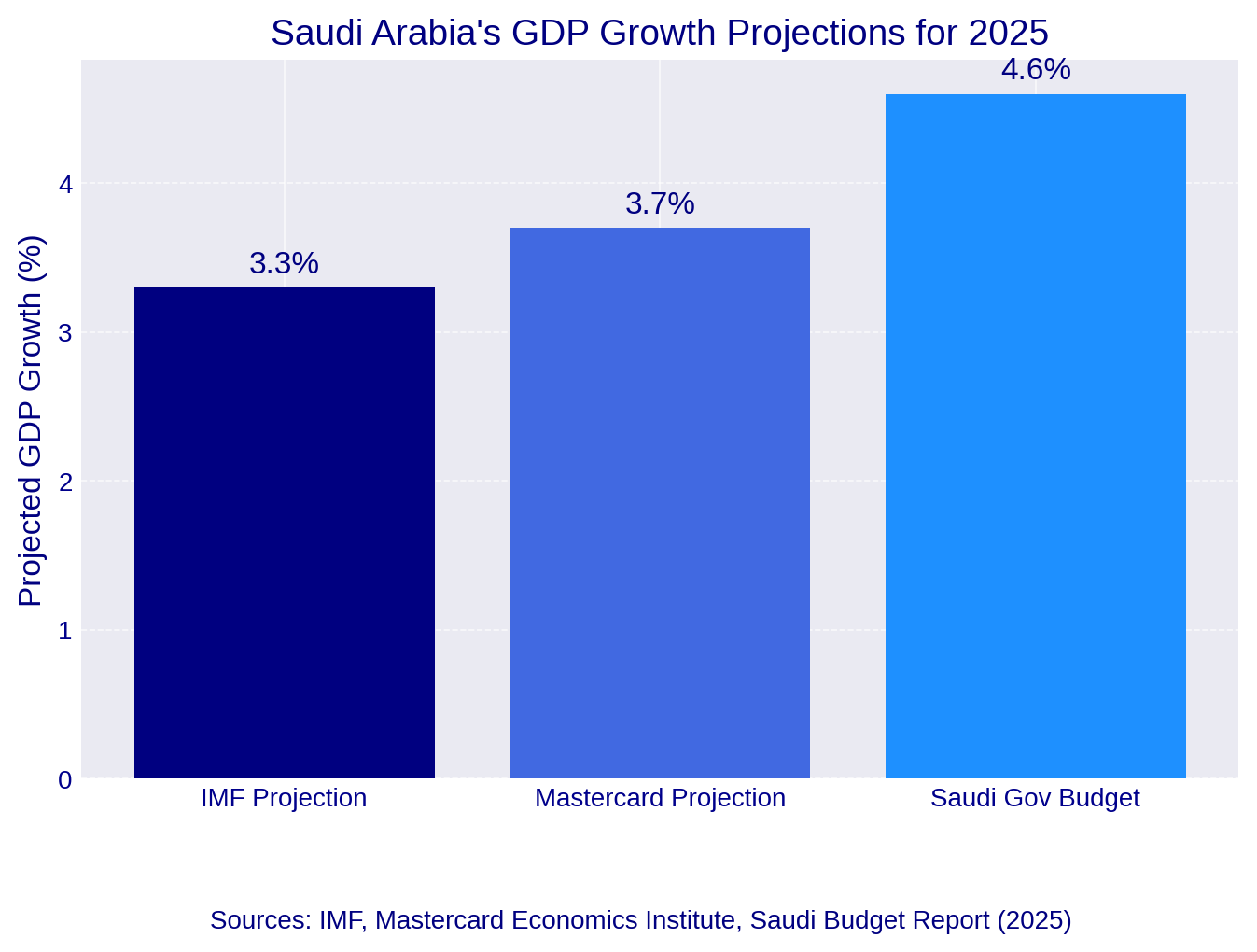

Saudi Arabia’s economy is projected to grow, with non-oil GDP expected to increase by 3.7% in 2025. This growth presents opportunities for companies well-positioned in the market.

Environmental, Social, and Governance (ESG) Assessment

ESG factors are increasingly influencing investment decisions. Assessments should cover:

- Environmental Impact: Evaluate the company’s sustainability practices and environmental footprint.

- Social Responsibility: Examine labor practices, community engagement, and customer relations.

- Governance Structure: Review board composition, transparency, and ethical guidelines.

Saudi Arabia’s Vision 2030 emphasizes sustainability and social development, making ESG considerations particularly relevant for investments in the region.

Technical Due Diligence

For companies in technology-driven sectors, technical due diligence is essential. This includes:

- Intellectual Property (IP): Verify ownership and protection of patents, trademarks, and copyrights.

- Product Development: Assess the pipeline of new products or services and their market readiness.

- Technical Debt: Identify any outdated technologies or systems that may require significant investment.

- Regulatory Compliance: Ensure that all technological aspects comply with relevant standards and regulations.

Incorporating a technical due diligence checklist can help identify potential risks and areas requiring investment to align with industry standards.

Cultural and Regional Considerations

Understanding the cultural context is vital, especially in regions like Saudi Arabia. Considerations include:

- Business Etiquette: Familiarize with local business practices and negotiation styles.

- Language: Ensure effective communication, possibly by engaging local translators or consultants.

- Cultural Norms: Respect local customs and traditions in business interactions.

Additional Considerations in Due Diligence for Private Equity Firms

In the evolving landscape of private equity, firms must adapt to emerging challenges and opportunities. Beyond traditional due diligence areas, several additional considerations have become increasingly pertinent. This section delves into these areas, providing insights and quantitative data to guide private equity firms in their investment strategies.

Regulatory Compliance and Reporting

- Corporate Sustainability Reporting Directive (CSRD) Compliance: The European Union’s Corporate Sustainability Reporting Directive (CSRD), effective from January 2023, mandates extensive sustainability disclosures from companies operating within its jurisdiction. Private equity firms with European portfolio companies must ensure compliance to avoid legal repercussions and enhance transparency. The CSRD requires detailed reporting on environmental, social, and governance (ESG) factors, with third-party assurance becoming mandatory. Companies currently under the Non-Financial Reporting Directive (NFRD) are expected to disclose under the CSRD by 2025, covering their 2024 data. This directive emphasizes the need for robust ESG due diligence processes to meet regulatory standards and stakeholder expectations.

- Financial Conduct Authority (FCA) Oversight: In the United Kingdom, the Financial Conduct Authority (FCA) has intensified its scrutiny of private markets. In 2025, the FCA plans to conduct in-person visits to private equity firms, focusing on valuation practices, risk management, and governance structures. This proactive approach aims to address potential risks associated with the growth and integration of private markets with traditional banking systems. Private equity firms must be prepared for increased regulatory interactions and ensure their internal processes align with the FCA’s expectations to mitigate compliance risks.

ESG Integration

- ESG Due Diligence Trends: ESG considerations have become integral to the due diligence process. A 2024 global study by KPMG revealed that 80% of dealmakers now include ESG factors in their M&A agendas. Furthermore, 45% of investors reported encountering significant deal implications due to material ESG findings during due diligence, with over half of these instances leading to deal terminations. This underscores the necessity for private equity firms to integrate comprehensive ESG assessments into their investment evaluations to identify potential risks and opportunities early in the process.

- Value Creation through ESG: Investors are increasingly recognizing the financial benefits of strong ESG performance. The same KPMG study indicated that 55% of respondents are willing to pay a premium of 1-10% for assets demonstrating high ESG maturity. This willingness to invest more highlights the perceived value addition through sustainable practices, risk mitigation, and alignment with evolving regulatory requirements. Private equity firms can leverage this trend by enhancing the ESG profiles of their portfolio companies, thereby potentially increasing their market valuations and attractiveness to future investors.

Market Dynamics and Economic Indicators

- Interest Rate Fluctuations: The macroeconomic environment, particularly interest rate trends, significantly influences private equity activities. In 2024, the Federal Reserve reduced its target interest rate by 100 basis points, bringing it below 5% for the first time since March 2023. This shift has made debt financing more accessible, potentially revitalizing M&A activities. Private equity firms should monitor interest rate movements closely, as they directly impact the cost of leveraged buyouts and the overall feasibility of potential investments.

- Deal Activity and Valuations: Despite previous economic uncertainties, private equity deal activity has shown resilience. In the first half of 2024, U.S. private equity deal value increased by 12% to $325.2 billion compared to the same period in 2023. This uptick suggests a recovering market, with firms adapting to new economic conditions. However, challenges such as stock market volatility and geopolitical tensions remain. Private equity firms must employ rigorous due diligence and remain agile to navigate these complexities effectively.

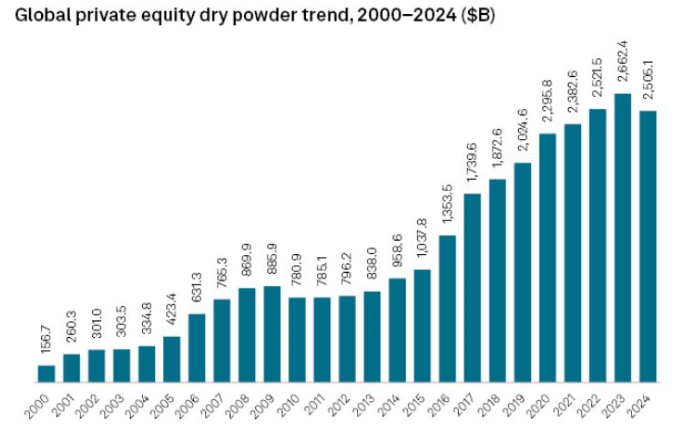

A more active market is anticipated in 2025, given the high levels of dry powder. With increased pressure on private equity funds to invest their capital in 2024 (particularly as various funds approach the end of their investment cycles on the back of several years of subdued deal-making), we saw a 6% decrease by the end of 2024 in the amount of dry powder, compared to the record $2.66 trillion of dry powder available at the end of 2023.

Technological Advancements and Data Analytics

- Leveraging Data in Due Diligence: The integration of advanced data analytics and artificial intelligence (AI) has transformed the due diligence landscape. Modern tools enable private equity firms to conduct more thorough and efficient analyses of potential investments. By utilizing AI-driven analytics, firms can uncover hidden patterns, assess risks more accurately, and make data-informed decisions. This technological adoption not only streamlines the due diligence process but also enhances the quality of insights derived, leading to more strategic investment choices.

Talent Acquisition and Management

- Evaluating Human Capital: The success of an investment often hinges on the quality of the target company’s management team. Private equity firms are placing increased emphasis on assessing the capabilities, track records, and cultural fit of key personnel. This evaluation extends beyond resumes to include leadership styles, adaptability, and alignment with the firm’s strategic vision. Ensuring that the human capital is robust and capable of driving growth is essential for the long-term success of the investment.

Exit Strategies and Liquidity Planning

- Planning for Exits: Developing a clear and viable exit strategy is a critical component of the investment process. With the market showing signs of recovery, private equity firms are exploring various exit avenues, including initial public offerings (IPOs), secondary sales, and strategic acquisitions. The choice of exit strategy depends on market conditions, the performance of the portfolio company, and investor expectations. Proactive planning and flexibility in approach can enhance returns and ensure timely exits.

How Insights KSA Can Help Private Equity Firms with Due Diligence

Insights KSA is a leading consulting and research firm specializing in market intelligence, financial analysis, and regulatory compliance advisory for private equity firms investing in Saudi Arabia. Here’s how Insights KSA can assist:

- Comprehensive Market Research – Insights KSA provides real-time market data, competitor analysis, and industry trend reports to help firms make informed investment decisions.

- Regulatory Compliance Assistance – With Saudi Arabia’s evolving legal framework, Insights KSA ensures that private equity firms comply with local laws, investment regulations, and ESG requirements.

- Financial and Risk Assessments – Insights KSA conducts deep financial due diligence, assessing revenue streams, profitability, debt structures, and valuation models to minimize investment risks.

- Operational and Technical Due Diligence – The firm evaluates a company’s operational efficiency, supply chain resilience, technology infrastructure, and cybersecurity measures to ensure scalability and risk mitigation.

- Exit Strategy Advisory – Whether planning an IPO, merger, or asset sale, Insights KSA provides strategic recommendations on optimal exit timing and valuation maximization.

- Cultural and Regional Insights – Given the unique business environment in Saudi Arabia, Insights KSA guides investors on local business etiquette, partnership opportunities, and government incentives.

FAQs

- What is an enhanced due diligence checklist, and why is it important for private equity firms? An enhanced due diligence checklist is a comprehensive evaluation tool used by private equity firms to assess investment opportunities beyond basic financial and legal checks. It includes in-depth analysis of financial stability, legal compliance, operational risks, environmental and social factors, and geopolitical concerns. This ensures that investments align with long-term profitability and risk mitigation strategies.

- What key factors should be included in a business acquisition due diligence checklist? A business acquisition due diligence checklist should include financial audits, legal compliance checks, operational evaluations, technology assessments, human resources reviews, and risk assessments. It helps private equity firms gain a complete understanding of the target company before making an investment.

- How does a technical due diligence checklist benefit private equity investments? A technical due diligence checklist assesses IT infrastructure, cybersecurity, intellectual property, technology stack, and software licensing. This ensures that the target company’s technology is scalable, secure, and aligns with the firm’s strategic goals.

- What challenges do private equity firms face in due diligence? Private equity firms often encounter challenges such as incomplete or misleading financial information, regulatory compliance risks, cybersecurity threats, market volatility, and geopolitical tensions. These factors make due diligence a critical process to mitigate risks.

- How does Saudi Arabia’s Vision 2030 impact private equity investments? Saudi Arabia’s Vision 2030 emphasizes economic diversification, promoting investments in sectors such as technology, healthcare, and renewable energy. Private equity firms must align their strategies with these initiatives to maximize opportunities and access government support.

Sources:

- https://www.jdsupra.com/legalnews/private-equity-deal-activity-review-8795129/

- https://www.imarcgroup.com/saudi-arabia-private-equity-market

- https://www.cbh.com/insights/reports/private-equity-report-2024-trends-and-2025-outlook/

- https://www.fnlondon.com/articles/revealed-audit-regulator-upgrades-risk-of-private-equity-investment-to-high-b797818e

- https://www.accenture.com/us-en/blogs/business-functions-blog/private-equity-trends-2025