In today’s complex financial landscape, the capacity to effectively manage risks is pivotal to the stability and growth of organizations. The financial risk management process provides a methodical framework for identifying, analyzing, and mitigating risks that could compromise an organization’s objectives and financial integrity. This practice is essential across industries, particularly in Saudi Arabia, where consulting companies such as Insights KSA play an instrumental role in navigating this intricate process.

This article delves into the six critical steps for a successful financial risk management process and underscores the significance of engaging professional financial and risk advisory firms to attain strategic goals.

Financial Risk Management Process

The financial risk management process is a structured approach to identifying, assessing, and addressing financial risks. These risks encompass market volatility, credit risks, operational inefficiencies, and legal and regulatory challenges. Implementing this process enables organizations to safeguard assets, enhance decision-making, and secure long-term sustainability.

The process holds particular importance in regions like Saudi Arabia, where businesses contend with unique market dynamics and regulatory requirements. Consulting companies in Saudi Arabia, such as Insights KSA, possess the expertise to adapt this process to meet both local and global standards.

Let us examine the six steps critical to effective financial risk management.

Step 1: Risk Identification

The initial step involves identifying potential risks that may disrupt operations or hinder objectives. Key risk categories include:

- Market Risks: Fluctuations in currency exchange rates, interest rates, and stock market movements.

- Credit Risks: Defaults by counterparties or an inability to fulfill financial obligations.

- Operational Risks: System failures, process inefficiencies, or human errors.

- Compliance Risks: Violations of legal or regulatory standards.

Accurate risk identification necessitates a deep understanding of the organization’s operations and the broader industry context. Engaging financial and risk advisory services at this stage ensures a comprehensive approach to risk identification.

Quantitative Insights:

- Cybersecurity Concerns: 58% of risk executives identify cybercrime as a top-five risk, with expectations of its significance increasing in the coming years.

- Top Risks for Chief Risk Officers (CROs): Approximately 30% of CROs rank direct financial impact, harm to customers, and reputational damage as their primary concerns.

Step 2: Risk Assessment and Analysis

Following identification, the focus shifts to assessing and analyzing risks based on their likelihood and impact. This step includes:

- Quantitative Analysis: Employing statistical models and historical data to measure potential financial consequences.

- Qualitative Analysis: Leveraging expert judgment and industry insights for evaluation.

Prioritizing risks by severity and probability ensures that critical threats receive the necessary attention. Insights KSA, a leading consulting company in Saudi Arabia, uses advanced analytical tools to deliver precise and actionable assessments.

Quantitative Insights:

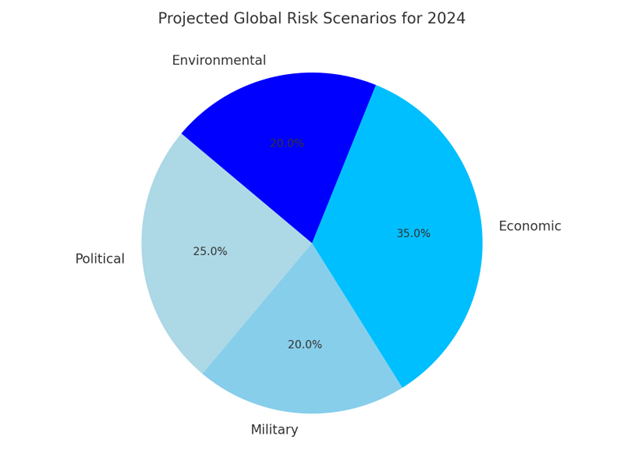

- Global Risk Scenarios: The Economist Intelligence Unit forecasts 10 critical global risk scenarios for 2024, including political, military, economic, and environmental risks.

Step 3: Risk Mitigation Strategies

Mitigation strategies aim to minimize or eliminate identified risks. Common approaches include:

- Diversification: Reducing exposure by spreading investments across asset classes.

- Hedging: Employing financial instruments to counterbalance potential losses.

- Process Enhancements: Streamlining operations to diminish risks.

- Compliance Mechanisms: Instituting robust policies to adhere to regulatory standards.

Financial and risk advisory firms customize mitigation strategies to align with organizational objectives and risk appetites. Insights KSA offers tailored solutions to address the specific challenges faced by businesses in Saudi Arabia.

Quantitative Insights:

- Investment in Risk Management: 36% of organizations plan to increase investment in risk management and compliance over the next two years.

Step 4: Implementation of the Risk Management Plan

Successful implementation of a risk management plan involves integrating it into the organization’s operations. This step entails:

- Resource Allocation: Designating budgets and personnel for plan execution.

- Control Establishment: Developing policies, procedures, and systems for risk monitoring.

- Employee Training: Equipping staff with the knowledge to fulfill their roles effectively.

Implementation is often a decisive factor in the overall success of the risk management process. Consulting firms like Insights KSA provide critical support to ensure seamless execution.

Quantitative Insights:

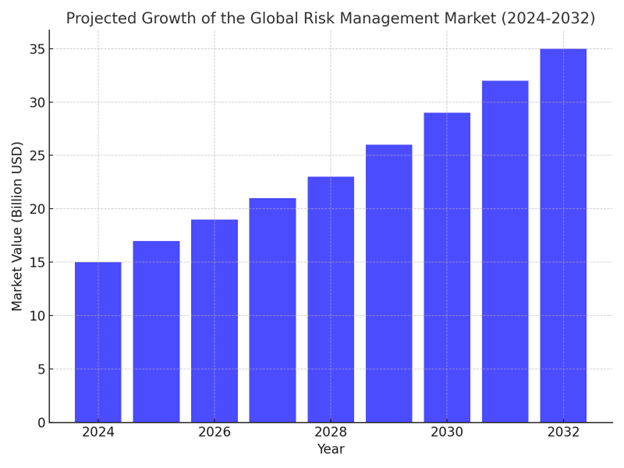

- Risk Management Market Growth: The global risk management market is expected to reach USD 35.9 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 13% during 2024-2032.

Step 5: Monitoring and Reporting

Continuous monitoring ensures that risk management strategies remain effective. This involves:

- Regular Audits: Assessing the performance of risk controls and policies.

- Real-Time Tracking: Leveraging technology to identify new risks as they emerge.

- Transparent Reporting: Keeping stakeholders informed with detailed updates.

Insights KSA employs advanced monitoring systems to help organizations maintain vigilance and make timely adjustments. Their expertise ensures alignment with dynamic market conditions.

Quantitative Insights:

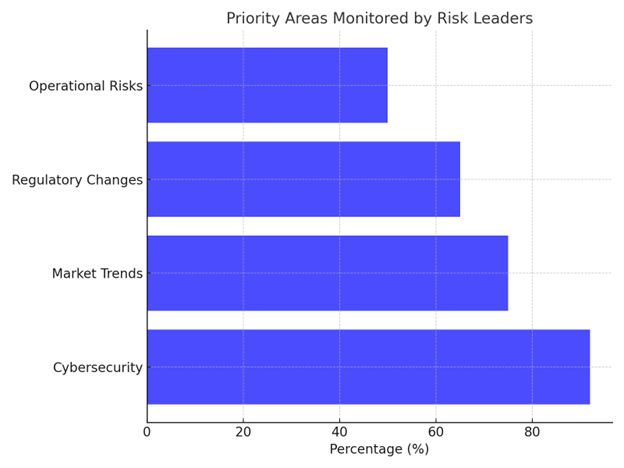

- Cybersecurity Monitoring: 92% of risk leaders closely monitor cyber developments, indicating the high priority of cybersecurity in risk management.

Step 6: Review and Refinement

To remain effective, the financial risk management process requires regular evaluation and updates. This step involves:

- Outcome Analysis: Comparing actual results with expectations.

- Adaptation: Adjusting plans to address emerging risks or seize new opportunities.

- Continuous Improvement: Integrating lessons learned into future strategies.

Periodic reviews conducted by financial and risk advisory firms provide valuable insights and ensure that strategies remain relevant. Insights KSA’s proactive approach guarantees that organizations maintain resilience in an evolving environment.

Quantitative Insights:

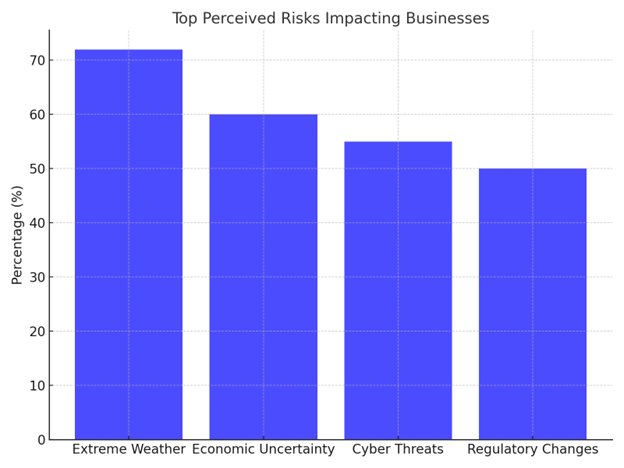

- Top Perceived Risks: 72% of risk professionals report that extreme weather events are the top perceived risk impacting their business and personnel in the next 12 months.

How Insights KSA Can Assist

Insights KSA is a trusted partner for businesses seeking excellence in financial risk management. Their comprehensive services include:

- Risk Identification: Leveraging advanced tools to pinpoint risks unique to your organization and industry.

- Detailed Analysis: Providing a balanced approach through quantitative and qualitative assessments.

- Strategic Solutions: Developing tailored mitigation strategies, including diversification and compliance measures.

- Expert Implementation: Ensuring smooth execution of risk management plans.

- Advanced Monitoring: Offering real-time tracking and regular reporting for informed decision-making.

- Proactive Reviews: Facilitating continuous refinement to enhance resilience and adaptability.

Whether navigating uncertain markets or building financial resilience, Insights KSA equips organizations with the tools and expertise required for long-term success.

Consulting companies in Saudi Arabia, such as Insights KSA, play an indispensable role in guiding organizations through this process. Their specialized expertise in financial and risk advisory ensures that businesses are equipped to manage risks with precision and achieve their strategic objectives.

As markets continue to evolve, partnering with trusted firms like Insights KSA provides the critical insights and support needed for sustained growth and resilience. Adopting a structured approach to financial risk management not only protects organizational assets but also lays the foundation for enduring success.

Source Links: