The Kingdom of Saudi Arabia has undergone significant economic transformation under its Vision 2030 initiative. One of the key pillars of this transformation is the growth of private equity (PE), which plays a critical role in diversifying the economy away from oil. This article explores the rise of private equity in Saudi Arabia, delving into its growth trajectory, sectoral focus, challenges, and opportunities. It also highlights the indispensable role of financial advisory services in the private equity ecosystem, with actionable insights for stakeholders.

Growth Trajectory of Corporate Strategy in Saudi Arabia

Private equity in Saudi Arabia has seen exponential growth over the past decade. This growth is driven by favorable government policies, increased investor confidence, and a growing appetite for alternative investments.

Key Statistics:

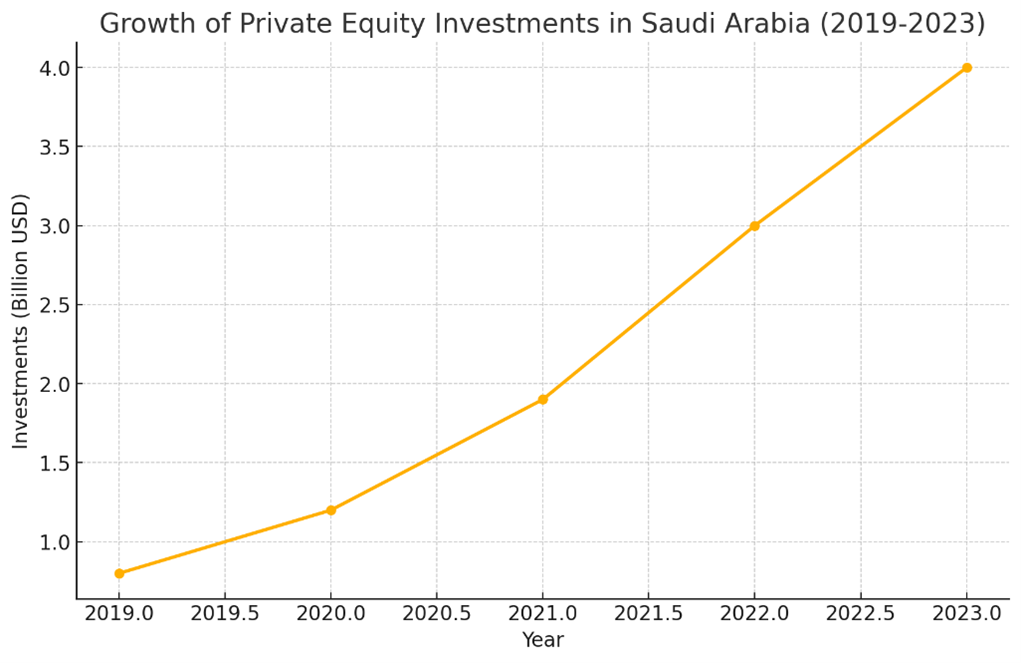

- Market Size: In 2023, the total value of private equity deals reached $4 billion, reflecting a 66% CAGR in investment from 2019 to 2023.

- Number of Deals: Private equity transactions have increased by 44% CAGR over the same period.

- Foreign Participation: The number of international PE firms entering Saudi Arabia has doubled since 2018, underscoring the Kingdom’s growing attractiveness as an investment destination.

Major Milestones:

- The establishment of the Public Investment Fund (PIF) as a cornerstone investor in private equity.

- The launch of specialized investment platforms such as Saudi Venture Capital Company (SVC) to promote private equity and venture capital.

Sectoral Focus of Corporate strategy Investments

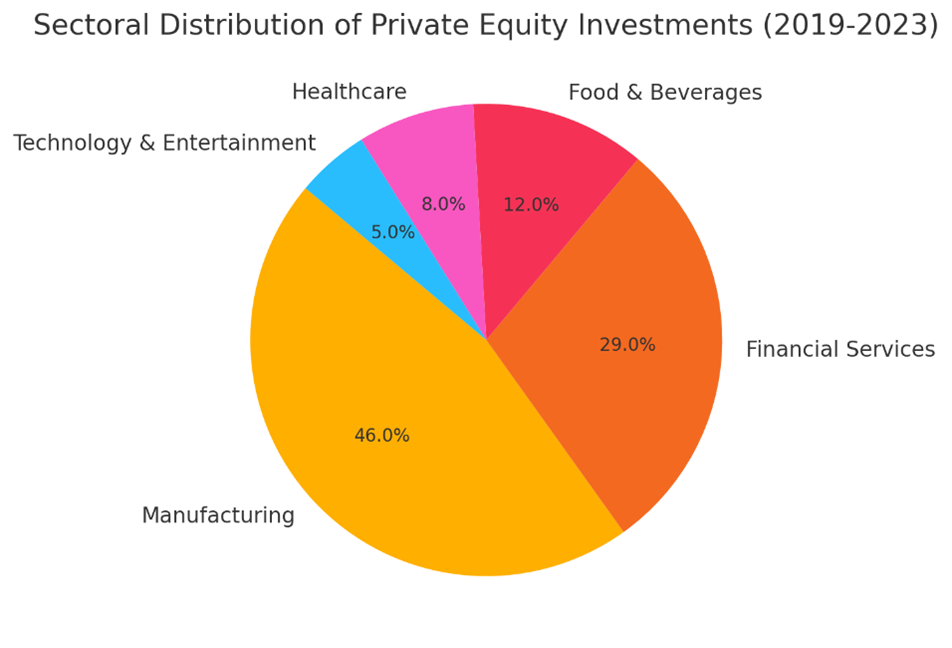

Private equity investments in Saudi Arabia have been concentrated in sectors that align with Vision 2030’s objectives, including manufacturing, financial services, healthcare, and consumer goods.

Sectoral Breakdown:

- Manufacturing (46%): The largest share of PE investments, driven by government incentives for industrialization.

- Financial Services (29%): A rapidly growing sector, fueled by fintech innovations and regulatory reforms.

- Food & Beverages (12%): Reflects the growing demand for diversified consumer products.

- Healthcare (8%): Investments aimed at modernizing healthcare infrastructure to meet increasing population needs.

- Technology & Entertainment (5%): Emerging sectors with immense growth potential.

Quantitative Analysis

The growth and distribution of private equity investments in Saudi Arabia can be better understood through data visualization.

Growth of Corporate Strategy Investments in Saudi Arabia (2019-2023)

Sectoral Distribution of Corporate Strategy Investments (2019-2023)

Challenges in Saudi Arabia’s Corporate Strategy Landscape

While private equity in Saudi Arabia has experienced significant growth, it is not without challenges:

- Regulatory Complexity

Despite progress, navigating Saudi Arabia’s evolving regulatory landscape remains a challenge for investors. Recent reforms have improved transparency but continue to require careful compliance.

- Market Fragmentation

The private equity market is still relatively young, and some sectors suffer from fragmentation and a lack of institutional frameworks.

- Valuation Uncertainty

Given the nascent state of some industries, determining accurate valuations for companies can be complex, affecting the due diligence process.

Opportunities for Corporate Strategy in Saudi Arabia

- Economic Reforms and Vision 2030

Vision 2030 has opened doors to new sectors, including tourism, entertainment, and renewable energy, offering untapped opportunities for private equity.

- Public-Private Partnerships (PPPs)

The government has been actively promoting PPPs, allowing private equity firms to invest in infrastructure and public services projects.

- Digital Transformation

Technology and fintech are on the rise, with increasing demand for digital solutions. This trend has been a significant driver of private equity interest in tech startups.

Role of Corporate and Capital Market Strategy in Corporate Strategy

Financial advisory services are indispensable in private equity transactions, helping investors navigate complex deals, assess risks, and maximize returns.

Key Contributions of Financial Advisors:

- Due Diligence: Comprehensive evaluations of potential investments.

- Valuation and Deal Structuring: Ensuring fair market value and optimal transaction design.

- Regulatory Compliance: Guiding firms through Saudi Arabia’s regulatory framework.

- Post-Investment Support: Enhancing operational efficiency and growth strategies.

The Impact of Vision 2030 on Corporate Strategy

Vision 2030 has been instrumental in shaping the private equity landscape in Saudi Arabia. This ambitious economic plan aims to reduce the Kingdom’s dependence on oil by fostering growth in non-oil sectors such as tourism, entertainment, healthcare, and technology.

Private equity plays a crucial role in this transformation by providing the capital and expertise needed to scale businesses in these sectors. For instance, the entertainment sector, which was virtually non-existent a decade ago, has now become a hotbed of private equity activity, thanks to reforms allowing the establishment of cinemas, theme parks, and live entertainment venues.

Additionally, Vision 2030 emphasizes the importance of small and medium-sized enterprises (SMEs) in driving economic growth. Private equity firms have been actively investing in SMEs, helping them scale operations, improve governance, and access new markets. This aligns with the government’s goal of increasing the SME sector’s contribution to GDP from 20% to 35% by 2030.

Technology and Innovation: A New Frontier for Corporate Strategy

The technology sector in Saudi Arabia is emerging as a new frontier for private equity investment. With the government’s focus on digital transformation, there has been a surge in demand for technology solutions across industries. This has created significant opportunities for private equity firms to invest in tech startups and scale-ups.

The fintech sector, in particular, has witnessed rapid growth, driven by regulatory support and increasing consumer adoption of digital financial services. Private equity firms have been instrumental in providing the capital and strategic guidance needed for fintech companies to expand their operations and develop innovative solutions.

Beyond fintech, sectors such as e-commerce, cloud computing, and cybersecurity are also attracting private equity interest. These investments are not only helping businesses scale but are also contributing to the overall digital transformation of the Saudi economy.

ESG Considerations in Corporate Strategy Investments

Environmental, Social, and Governance (ESG) factors are becoming increasingly important in private equity investments. In Saudi Arabia, ESG considerations are gaining traction, driven by both regulatory pressures and investor demand.

Private equity firms are integrating ESG factors into their investment strategies to align with global best practices and meet the expectations of institutional investors. This includes investing in companies that prioritize sustainability, promote social responsibility, and adhere to strong governance standards.

The renewable energy sector is a prime example of how ESG considerations are shaping private equity investments in Saudi Arabia. The Kingdom’s commitment to reducing its carbon footprint and transitioning to clean energy has created significant opportunities for private equity firms to invest in solar and wind energy projects.

Moreover, private equity firms are increasingly focused on improving the ESG performance of their portfolio companies. This not only enhances the companies’ value but also ensures long-term sustainability and compliance with evolving regulatory requirements.

Future Outlook for Corporate Strategy in Saudi Arabia

The future of private equity in Saudi Arabia looks promising, with several factors poised to drive continued growth. The Kingdom’s ongoing economic diversification efforts, coupled with its favorable demographic profile and increasing openness to foreign investment, create a conducive environment for private equity activity.

Emerging sectors such as technology, renewable energy, and tourism offer significant growth potential, while the government’s commitment to improving the business environment is likely to attract more international private equity firms.

How Insights Can Help

Insights offer a critical advantage for stakeholders in Saudi Arabia’s private equity market. Here’s how Insights can help:

- Market Research: Provides data-driven analysis of investment opportunities.

- Strategic Advisory: Helps firms align their investments with growth objectives.

- Regulatory Updates: Keeps investors informed of policy changes affecting the market.

- Risk Management: Identifies and mitigates potential risks to protect investment returns.

By leveraging these insights, private equity firms and investors can optimize their strategies, stay ahead of market trends, and capitalize on emerging opportunities in Saudi Arabia.