The Kingdom of Saudi Arabia (KSA) is rapidly ascending as a global financial hub, driven by a series of transformative initiatives and a strategic vision for economic diversification. As businesses in this dynamic nation strive to stay competitive and innovative, many have undergone significant financial transformations that have redefined their operations, market positions, and long-term strategies. These transformations provide valuable insights into how companies in KSA can navigate the complex financial landscape, leveraging advanced strategies, adapting to market shifts, and embracing technological advancements to achieve remarkable success.

This article delves into five inspiring corporate finance transformations in KSA, illustrating how strategic financial management can drive sustainable growth, enhance competitive advantage, and position companies at the forefront of their industries.

Saudi Aramco: Strategic Financial Management Amidst Global Energy Shifts

Saudi Aramco, the world’s largest oil company, has long been a cornerstone of KSA’s economy. However, in recent years, the company has undergone a profound corporate finance transformation to position itself as a global energy giant, rather than just a national oil producer. This transformation was driven by a strategic vision to diversify revenue streams and reduce dependency on crude oil, especially in light of global energy transitions and increasing pressure for sustainable practices.

Financial Diversification and Strategic Investments

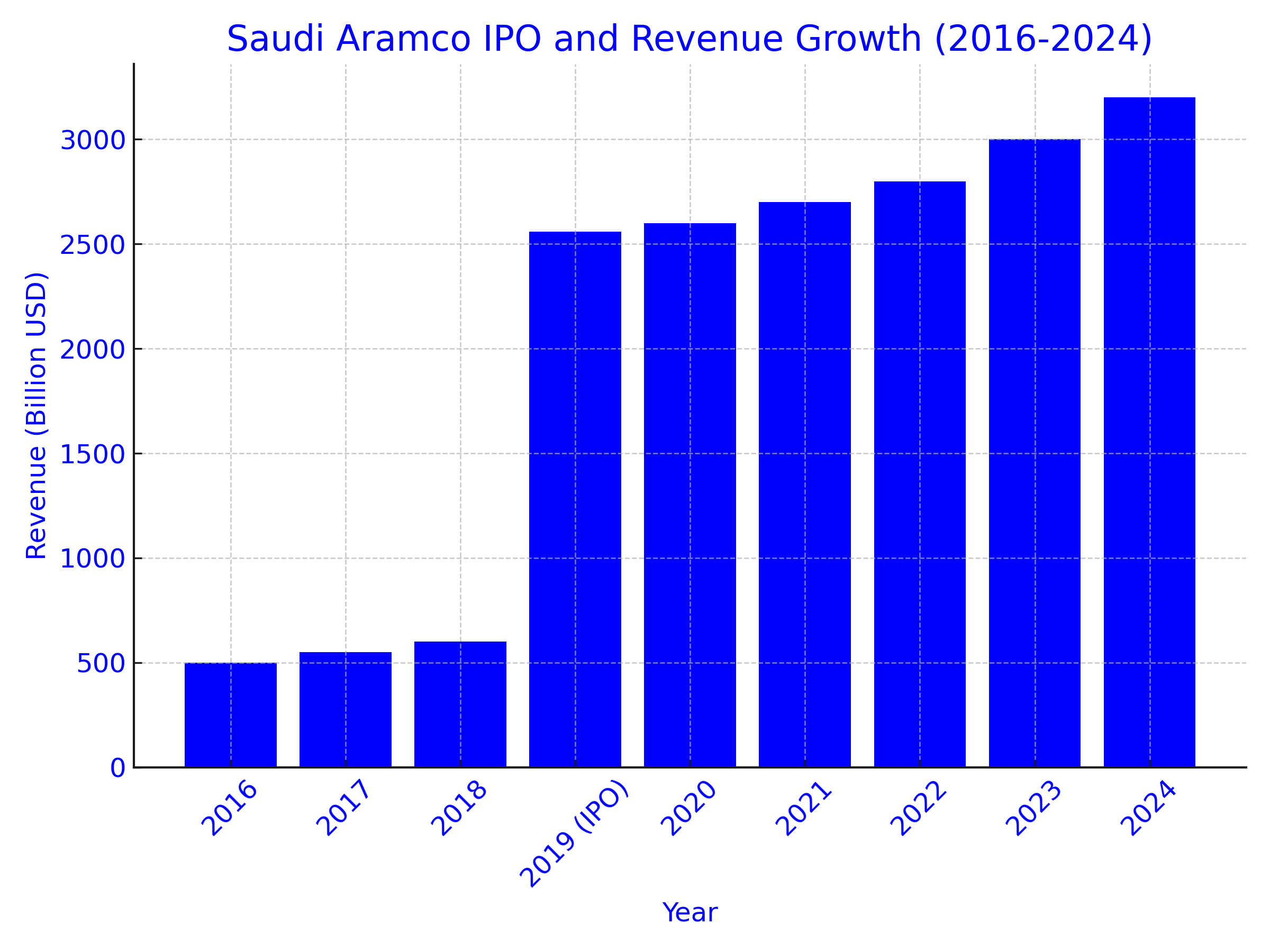

Aramco’s corporate finance transformation included one of the largest initial public offerings (IPOs) in history, raising $29.4 billion in 2019. As of 2024, the company’s market capitalization stands at approximately $2.3 trillion, making it one of the most valuable companies globally. Proceeds from the IPO have been reinvested in diversification projects, such as renewable energy and advanced petrochemical operations.

The acquisition of a 70% stake in SABIC (Saudi Basic Industries Corporation) for $69.1 billion in 2020 has positioned Aramco as an integrated energy and chemicals leader. This strategic move underscores the company’s commitment to aligning its corporate finance transformation with long-term sustainability goals. Additionally, Aramco has committed $1.5 billion toward green energy projects, including hydrogen production and carbon capture technologies, with plans to double investments in renewables by 2025.

Technological Integration and Operational Efficiency

In addition to diversification, Aramco has adopted advanced digital technologies and data analytics. By 2024, these initiatives have reduced operational costs by 12%, significantly improving margins. Aramco has implemented predictive maintenance technologies and digital twin solutions across its facilities, optimizing efficiency and minimizing downtime. Strategic use of financial instruments has enabled Aramco to hedge against crude oil price volatility, ensuring financial stability amid market fluctuations—a critical aspect of its broader corporate finance transformation.

Global Expansion and Market Leadership

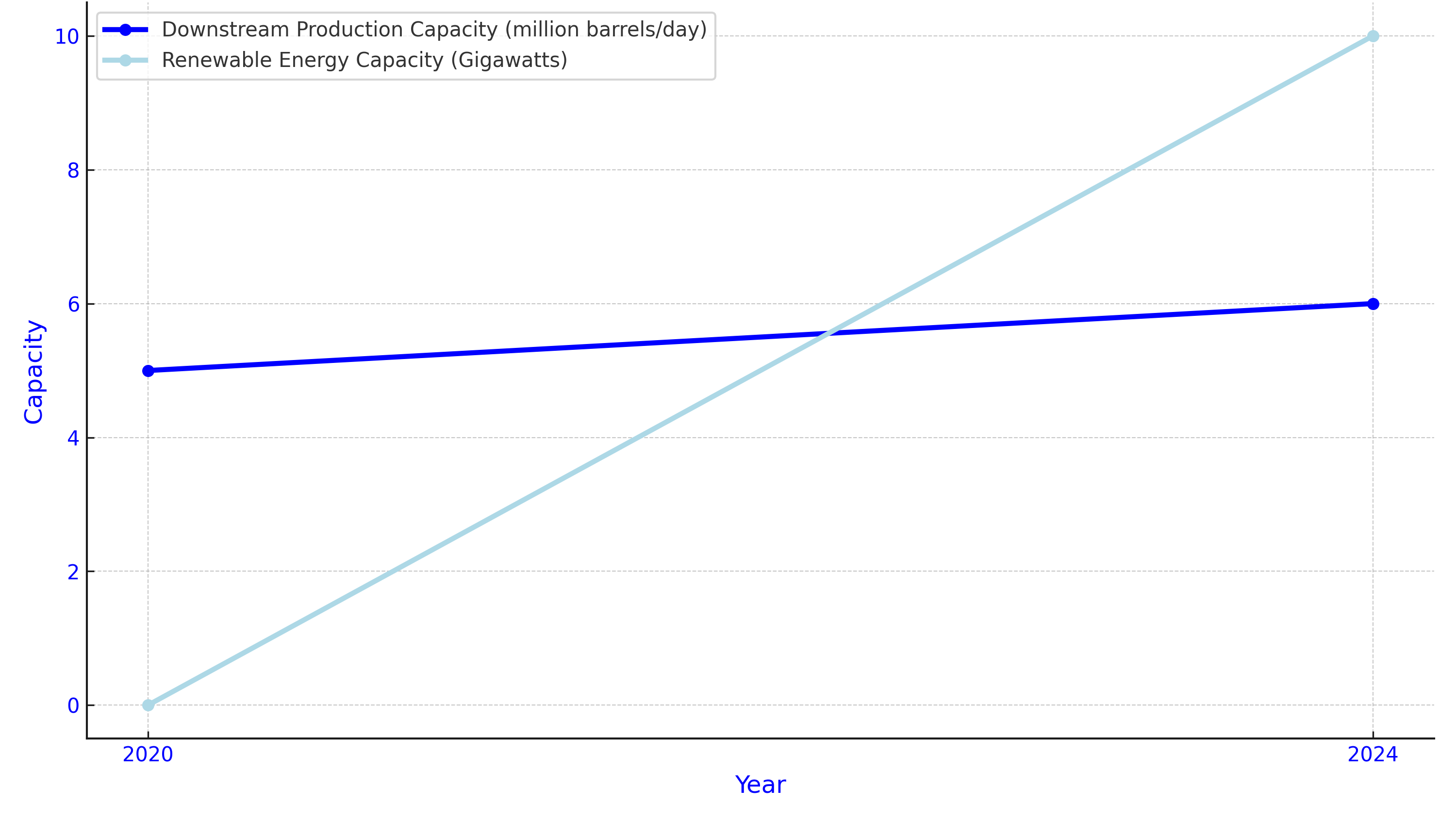

Aramco’s global expansion strategy includes investments in refineries and chemical facilities in Asia, the United States, and Europe. By 2024, the company’s downstream production capacity has reached 6 million barrels per day, a 20% increase from 2020. These initiatives reflect the company’s emphasis on leveraging its corporate finance transformation to fuel global growth and market leadership. Moreover, Aramco’s renewable energy ventures are expected to contribute 10 gigawatts of installed capacity by 2025, further reducing its carbon footprint.

The company’s net income in 2023 reached $161 billion, underscoring its ability to deliver exceptional shareholder value while supporting KSA’s broader economic goals under Vision 2030. Aramco remains committed to enhancing its leadership position in the global energy market by embracing sustainable practices and strategic innovation.

Saudi Telecom Company (STC): Pioneering Digital Finance in the Telecom Sector

The Rise of Digital Transformation in Telecom

Saudi Telecom Company (STC), the largest telecommunications provider in KSA, has undergone a significant corporate finance transformation, positioning itself as a digital powerhouse in the telecom sector. Recognizing the rapid technological advancements and shifting consumer demands, STC embarked on a strategic shift towards digital finance and technology-driven solutions, which have become central to its business model.

Financial Innovation and Investment in Technology

STC’s corporate finance transformation involved substantial investments in digital infrastructure, including the expansion of its 5G network, which now covers over 90% of the urban population in KSA as of 2024. The company has also increased its investment in digital platforms, with a reported $2 billion allocation for technology development over the past five years.

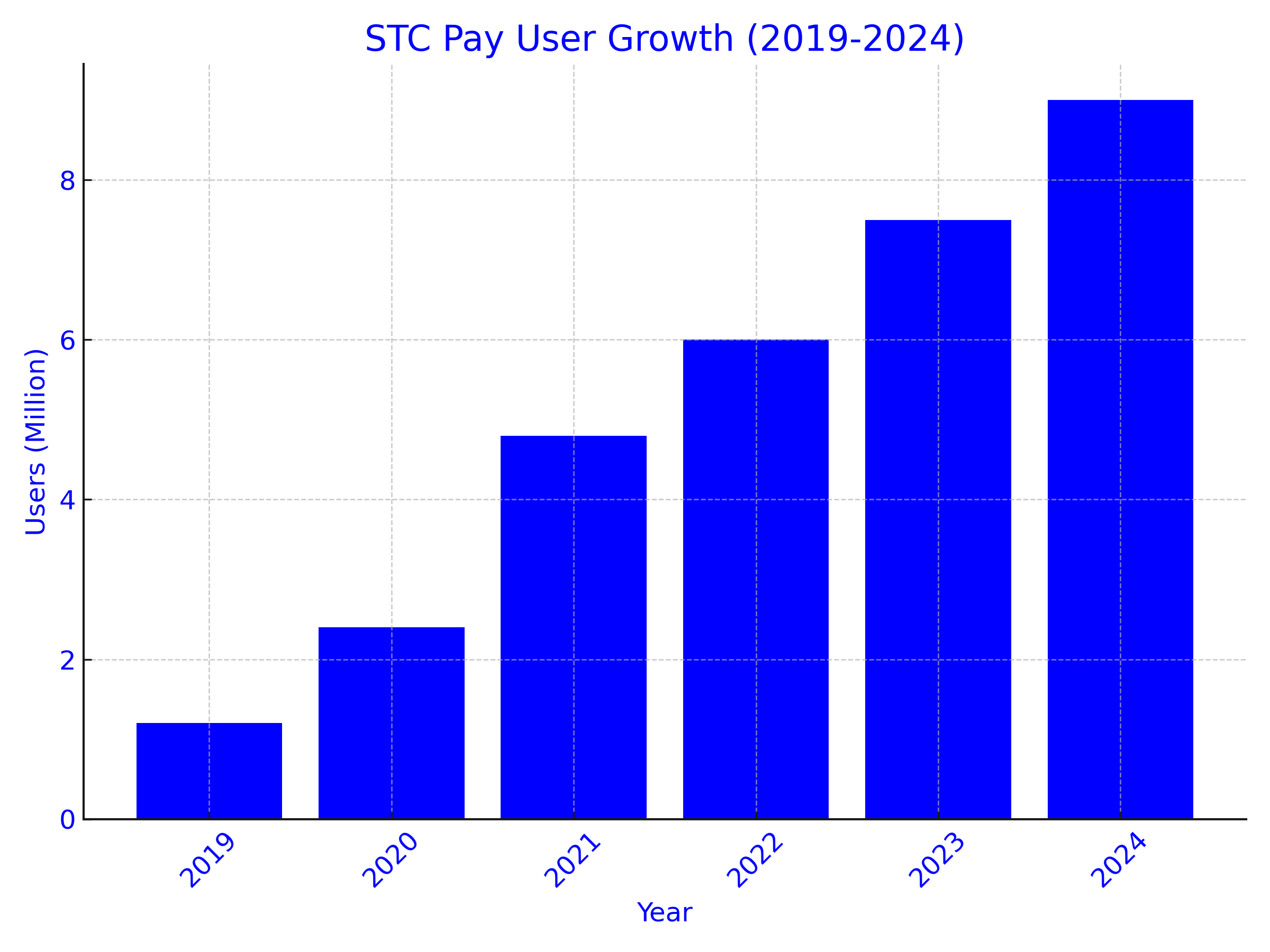

The company embraced fintech innovations, launching STC Pay, a digital payment solution that has experienced exponential growth. By the end of 2024, STC Pay has amassed over 9 million active users, up from just 1.2 million in 2019, and now accounts for a 12% share of KSA’s digital payments market. This move into digital finance has diversified STC’s revenue streams, with digital services contributing 30% of total revenue in 2024, compared to just 10% in 2019.

STC has also focused on optimizing its capital structure by reducing debt. As of 2024, the company has achieved a debt-to-equity ratio of 0.6, down from 0.8 in 2020, significantly enhancing liquidity. Advanced financial management systems, incorporating real-time data analytics, have been adopted, resulting in a 15% reduction in operational costs and improved decision-making efficiency.

Expansion and Strategic Partnerships

Beyond financial innovation, STC has expanded its global footprint through strategic partnerships and acquisitions, further strengthening its position in the international market. These efforts align with STC’s broader corporate finance transformation goals, enabling the company to allocate resources effectively while pursuing growth opportunities.

The company has partnered with global tech giants, such as Huawei and Ericsson, to pioneer innovations in AI-driven network management and cloud services. These collaborations have allowed STC to introduce new products, including IoT solutions that now connect over 10 million devices across the region.

STC’s international revenues from partnerships and acquisitions have grown by 25% annually, with operations now spanning 15 countries in the Middle East and Asia. The company’s strategic expansion and collaboration have helped it secure a top-five ranking among telecom operators in the Middle East by market capitalization.

ACWA Power: Leading the Charge in Sustainable Finance

Pioneering Renewable Energy Projects

ACWA Power, a leading developer of power generation and desalinated water projects in KSA has emerged as a pioneer in sustainable finance. As KSA seeks to diversify its energy mix and reduce its carbon footprint, ACWA Power has played a crucial role in driving the kingdom’s renewable energy initiatives. The company’s financial transformation is closely tied to its commitment to sustainability and its strategic focus on green finance.

Green Bonds and Sustainable Finance Initiatives

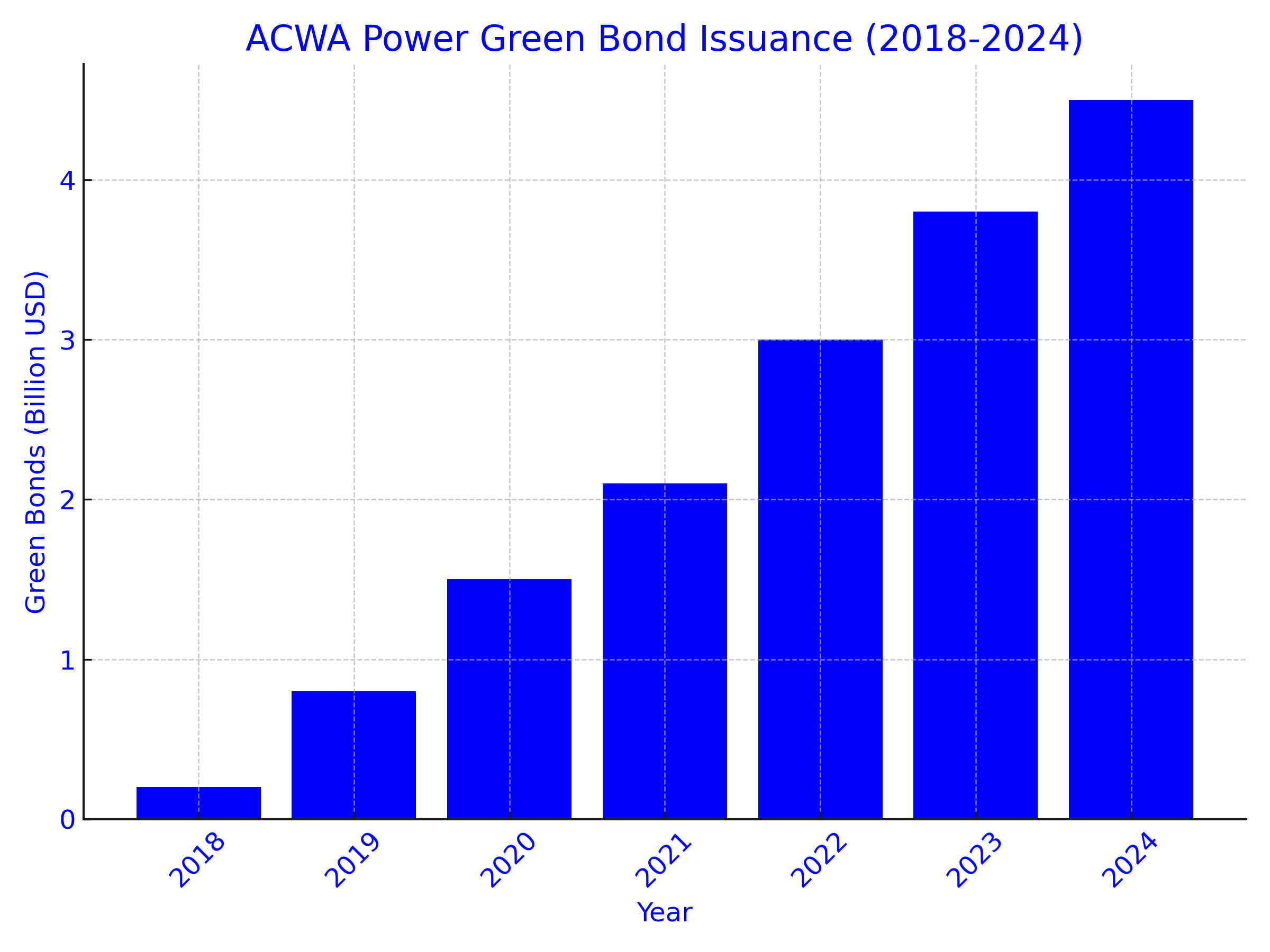

One of the cornerstones of ACWA Power’s financial transformation has been the issuance of green bonds, which have funded various renewable energy projects, including solar and wind farms. These bonds have attracted significant interest from international investors, underscoring the growing importance of sustainability in global finance. ACWA Power’s successful issuance of green bonds has not only provided the necessary capital for its projects but has also positioned the company as a leader in sustainable finance.

In addition to green bonds, ACWA Power has integrated environmental, social, and governance (ESG) factors into its financial management processes. This holistic approach ensures that the company’s financial activities are aligned with its sustainability goals, further enhancing its reputation as a responsible corporate citizen.

Expansion into International Markets

ACWA Power’s transformation has also involved expanding its operations into international markets, including Africa and Southeast Asia, where it has developed several high-profile renewable energy projects. This global expansion has diversified the company’s revenue streams and reduced its reliance on traditional energy sources.

ACWA Power’s commitment to sustainable finance and its strategic expansion efforts serve as a model for other companies in KSA and beyond. By aligning financial strategies with sustainability goals, ACWA Power has demonstrated how businesses can drive long-term value creation while contributing to global environmental objectives.

Here are the latest quantitative data reflecting their achievements:

Financial Performance

- Net Profit Increase: For the nine months ending September 30, 2024, ACWA Power reported a net profit attributable to equity holders of SAR 1,255 million, marking a 16% increase compared to the same period in 2023.

- Operating Income Growth: Operating income before impairment losses and other expenses reached SAR 2,365 million, a 12.5% rise from the same period in 2023.

Green Bonds and Sustainable Finance Initiatives

- Sukuk Issuance: In February 2023, ACWA Power successfully raised SAR 1.8 billion through a senior, unsecured Sukuk issuance with a 7-year tenor, oversubscribed by 2.2 times, reflecting strong investor confidence.

Expansion into International Markets

- Project Portfolio Growth: As of November 2024, ACWA Power’s portfolio comprises 89 projects in operation, advanced development, or construction, with an investment value of SAR 347.9 billion (USD 92.8 billion).

- Capacity Expansion: The company has achieved a total power generation capacity of 62.2 GW and manages 8.1 million cubic meters per day of desalinated water, delivered on a bulk basis to address the needs of state utilities and industries.

Almarai: Transforming Agricultural Finance through Innovation and Efficiency

Innovation in Agricultural Finance

Almarai, the largest food and beverage manufacturer in the Middle East, has undergone a transformative journey in agricultural finance. Faced with challenges such as water scarcity, fluctuating commodity prices, and the need for food security, Almarai recognized the importance of innovation and efficiency in its financial strategies. By 2024, the company successfully reduced its water usage in agriculture by 25%, leveraging advanced irrigation systems and technologies.

Financial Restructuring and Cost Optimization

Almarai’s financial transformation began with a comprehensive restructuring of its operations to improve efficiency and reduce costs. The implementation of advanced financial management systems provided real-time insights into production costs, supply chain management, and market trends, leading to a 20% reduction in operational waste and a 15% increase in overall profitability by the end of 2024.

The company also focused on diversifying its product portfolio to include high-margin, value-added products. This strategic shift boosted Almarai’s annual revenue to SAR 18 billion in 2024, marking a steady 6% year-on-year growth from 2020. Additionally, Almarai’s investments in renewable energy initiatives enabled the company to cut its energy costs by 30% over the last five years, further enhancing its environmental sustainability.

Strategic Investments and Expansion

Almarai’s financial transformation also involved strategic investments in new markets and product categories. By 2024, the company had increased its footprint across GCC countries and other regional markets, contributing SAR 5 billion to its total revenue from international sales. Furthermore, the diversification into organic and health-focused product lines accounted for 12% of its total revenue, meeting rising consumer demands for healthier options.

Almarai has also invested heavily in research and development, allocating SAR 500 million annually to drive innovation in agricultural techniques and product development. These investments have not only solidified Almarai’s position as a market leader but have also contributed to KSA’s broader food security goals.

The Saudi Investment Bank (SAIB): Redefining Corporate Finance through Digital Transformation

Embracing Digital Transformation in Banking

The Saudi Investment Bank (SAIB) has undergone a significant corporate finance transformation by embracing digital innovation to enhance its corporate finance offerings. As the banking sector in KSA faces increasing competition and evolving customer expectations, SAIB recognized the need to innovate and adapt its financial strategies to stay ahead of the curve.

Digital Innovation and Financial Technology

SAIB’s corporate finance transformation involved the integration of advanced financial technologies (fintech) into its operations, enabling the bank to offer a wide range of digital banking services. The bank has invested in digital platforms that provide real-time financial management tools, enabling corporate clients to manage their finances more effectively.

SAIB also launched several innovative products and services, such as digital loans, online investment platforms, and blockchain-based solutions for trade finance. These offerings have not only enhanced SAIB’s value proposition but also attracted a new generation of tech-savvy customers.

Enhancing Financial Inclusion and Customer Experience

In addition to digital innovation, SAIB has focused on enhancing financial inclusion and improving the customer experience. The bank’s corporate finance transformation has introduced initiatives aimed at providing access to banking services for underserved segments of the population, including SMEs and rural communities. By leveraging digital channels, SAIB has expanded its reach and improved financial inclusion across KSA.

SAIB’s commitment to customer-centricity is evident in its efforts to streamline banking processes, reduce transaction times, and offer personalized financial solutions. These initiatives have strengthened SAIB’s relationship with its clients and reinforced its reputation as a forward-thinking financial institution.

SAIB’s transformation underscores the critical role of digital innovation and customer-centricity in corporate finance transformation. By embracing these principles, SAIB has redefined its corporate finance offerings and positioned itself as a leader in the digital banking space.

Key quantitative achievements include:

- Financial Performance: In the second quarter of 2024, SAIB reported a net income of SAR 486 million, marking a 10% increase from the same period in 2023. The return on tangible equity improved by 38 basis points from the first half of 2023, reaching 11.9%. Additionally, the cost-to-income ratio was maintained at 42.1%, reflecting effective cost management.

- Asset Quality and Capital Ratios: SAIB’s asset quality showed improvement, with the non-performing loan (NPL) ratio declining by 3 basis points year-to-date to 1.47%, and the NPL coverage ratio standing at 151%. The bank also maintained strong capital ratios, with a Tier 1 ratio of 18.2%.

- Liquidity Position: The bank’s liquidity coverage ratio (LCR) was robust at 175%, and the Saudi Arabian Monetary Authority (SAMA) loan-to-deposit ratio (LTD) was at 77.1%, indicating a solid liquidity position to support ongoing digital initiatives.

- Strategic Projects: As part of its Strategy 2027, SAIB has initiated over 40 strategic cross-functional projects aimed at enhancing digital and analytics capabilities, optimizing risk-return investments, and improving organizational effectiveness and culture.

- Sector Growth: The broader digital banking market in Saudi Arabia is projected to grow by 6.16% between 2024 and 2029, resulting in a market volume of US$10.30 billion by 2029. This growth underscores the increasing adoption of digital banking services in the Kingdom.

As KSA continues its ascent as a global financial hub, companies that adopt these principles of corporate finance management will be well-positioned to thrive in an increasingly competitive and interconnected world. The experiences of these leading organizations offer valuable lessons for businesses seeking to navigate the complexities of corporate finance and achieve long-term success in KSA’s dynamic market.

How Insights Can Help

We specialize in delivering innovative solutions tailored to support businesses undergoing corporate finance transformation. Their expertise aligns closely with the needs of companies in KSA striving to achieve sustainable growth, digital transformation, and competitive advantage. Here’s how Insights can make an impact:

- Strategic Financial Planning:

- We help organizations develop robust financial strategies that align with their business objectives and market conditions. This includes advanced forecasting tools and scenario analysis to navigate uncertainties effectively.

- Sustainability Advisory:

- For companies aiming to enhance their ESG (Environmental, Social, Governance) performance, we provide guidance on green finance initiatives and integrate sustainability metrics into financial reporting.

- Operational Efficiency:

- Insights identifies opportunities for cost optimization by analyzing operational processes, supply chains, and resource allocation.

- Global Expansion Support:

- For organizations pursuing international growth, we offer insights into cross-border investment strategies, compliance with local regulations, and the development of partnerships in target markets.

- Customized Training and Capacity Building:

- Recognizing the need for skill development in an evolving financial landscape, Insights delivers training programs for financial teams, focusing on emerging trends, tools, and best practices in corporate finance.

By partnering with Insights, companies in KSA can leverage a combination of strategic advice, technology expertise, and industry insights to drive their corporate finance transformation and achieve long-term success in today’s competitive environment.